Weekly Update

ADMIN STUFF

Everyone's request to get the indicator has been fulfilled. If you haven't heard back then resend the email (newsletterqueryglobal@gmail.com). Will get those sorted.

BIG PICTURE - CYCLE

The bull thesis is playing out and is on track. No change in the targets.

In fact, they have been revised upwards.

In terms of cycle targets, I expect

BTC 160k-200K

ETH 12k -15K

When SOL was in the teens I had called for 450 in the bull thesis.

Now I am expecting

SOL 700-900

Rest I will cover, along with my thesis and new cycle picks in the next update of the bull thesis.

for now, any corrections are opportunities for adding to core positions IMO.

From a short-term perspective, strong support for BTC lies at 36K region.

We got the ETF approval we wanted.

Its a great thing for the crypto space overall but not for someone who wants to actively trade BTC. Why?

1. Theres going to be an incredible amount of noise from traditional & social media.

You will have so many people tracking and reporting meaningless metrics making it sound like euphoria or depression on a daily basis just to get engagement.

Ignore all the news with someone tweeting X amount of inflows and outflows.

Those are just short term market adjustments.

What really matters is

- the biggest asset manager on the planet going on National television and promoting crypto like his life depends on it.

- US presidential election candidate openly saying he's pro-crypto and issuing NFT collection.

- After approving the ETF, less chance of regulators harassing the companies operating in the space.

All of this is going to bring the masses, attention, and money into crypto.

- You wanted institutions. Now they are here.

But they will have your lunch money if you trade in their LTF arena.

TradFI asset managers are built to minimize volatility while extracting whatever return they can get.

Also, they need to be seen as "doing" something why else would you pay them 2/20 fees? if all they did was buy and hold.

Its a totally different thing that many wont be able to even beat buy and hold.

So in short their majority focus is going to be arbitrage strategies.

BTC is a 24/7 trading asset while ETFs are not. So they will deploy so much intellect, compute and $$$ to extract any juice that's there from those opening-closing windows, it won't be worthwhile trading BTC on LTF.

You are just better off trading either HTF or just holding it for the entire cycle.

The good news is Alts, especially where pros can't get in is where the maximum benefit ROI lies.

Coming to the trend model update.

I had sent out a note when the correction had just begun - SIGNS of Momentum fading

this is how the indicator is doing on a daily TF.

Bulk of the action remains in Alts.

Solana Memes

As mentioned previously

NOTE: Going forward will NOT be tracking them along with the trend model updates as these cannot be purely played via trend models and the price is a lot more volatile.

sometimes even 90% drawdown before they do 10x-20x.

also, it confuses a lot of subs and many cannot differentiate between value and momentum despite tons of explanations.

treat meme picks as zero or hero cycle plays.

If it moves 10x-20x don't wait for model updates.

formulate your own profit booking and reentering strategy.

The WYNN trade is working out well. Was up almost 2x.

Among all the Sol meme plays.

WIF POPCAT continues to be a no-brainer.

MEOW did a 13x post-the-note but reversed all the gains the moment the Jup dev came out with his statement against the coin. Stranger things have happened in crypto but likely that the story here is over.

CIRCLE and PAINT are strong and growing. These are good dips to add for those who like these plays.

KPOP is looking strong and has the same footprint of WYNN before it broke out.

Momentum in MONK seems to be waning.

BONK is a no-brainer cycle play too but can be better played via the web3quant indicator.

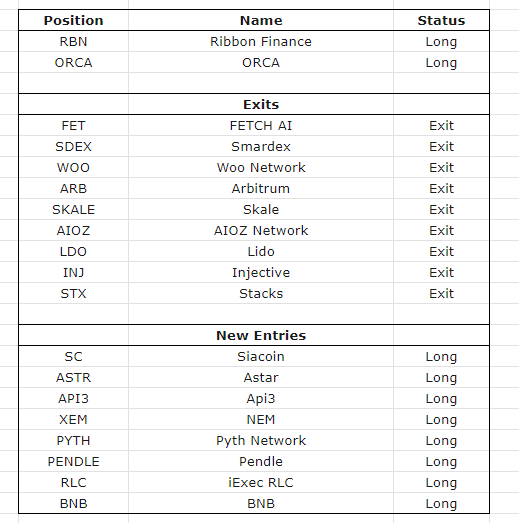

Coming to Crypto model positions.

There have been multiple entries and exits.

Crypto Stocks

There's been a big correction in the crypto stocks. Again referring to the big picture these are good opportunities to add to picks mentioned in the bull thesis especially if BTC touches 36k levels.

If you want only the strongest names then COIN GLXY KR1 CLSK MARA

Nothing wrong with HUT8 or RIOT, they will do well overall but among BTC miners the fastest horses likely to be CLSK and MARA

Miners as a basket are likely to do 3x the gains BTC does.

Purely from a trend model perspective here's how the indicator has done.

Heres the indicator HOW TO guide.

** Web3Quant is not registered with any financial regulatory agencies. Web3Quant content is purely for research, education, and entertainment purposes and should NOT be considered personalized financial advice. Do your own research and consult your financial advisor.**