Web3Quant Model Performance 2022

Let's get the weekly Crypto update out of the way first then we can evaluate Models 2022 performance.

Model continues to be in 100% Cash.

As we speak there's a nice rally in Alts but it's too early to conclude anything from it. Till we get a high time-frame breakout and models long confirmation, most of what I wrote in last week's update is still relevant.

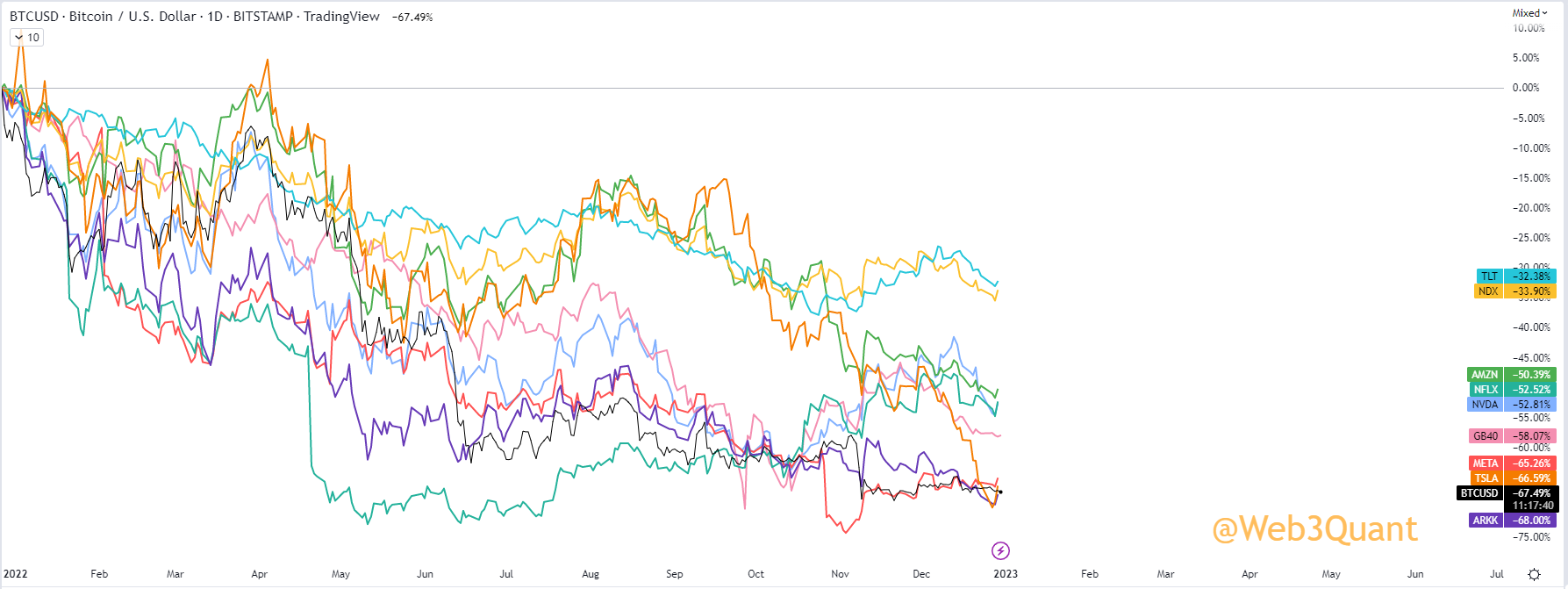

Like everything in life, context matters. To evaluate Models performance let's look at how the overall environment has been.

2022 was one of those rare years where even the super-conservative

Bond investors were hammered along with Crypto & Stocks investors.

The performance of the 60/40 portfolio was one of the worst since the Great Depression in over 100 years.

As you can see below, while Bitcoin gets all the bad press for volatility and performance. Things like UK Government Bonds and household names like Amazon, Netflix, and Facebook have shown equally terrible performance.

TL;DR

Model went into 100% CASH Nov 2021 which turned out to be the Major top for Crypto. Crypto Marketcap is down -75% since. Many of the Alt-coins are down over 95% since.

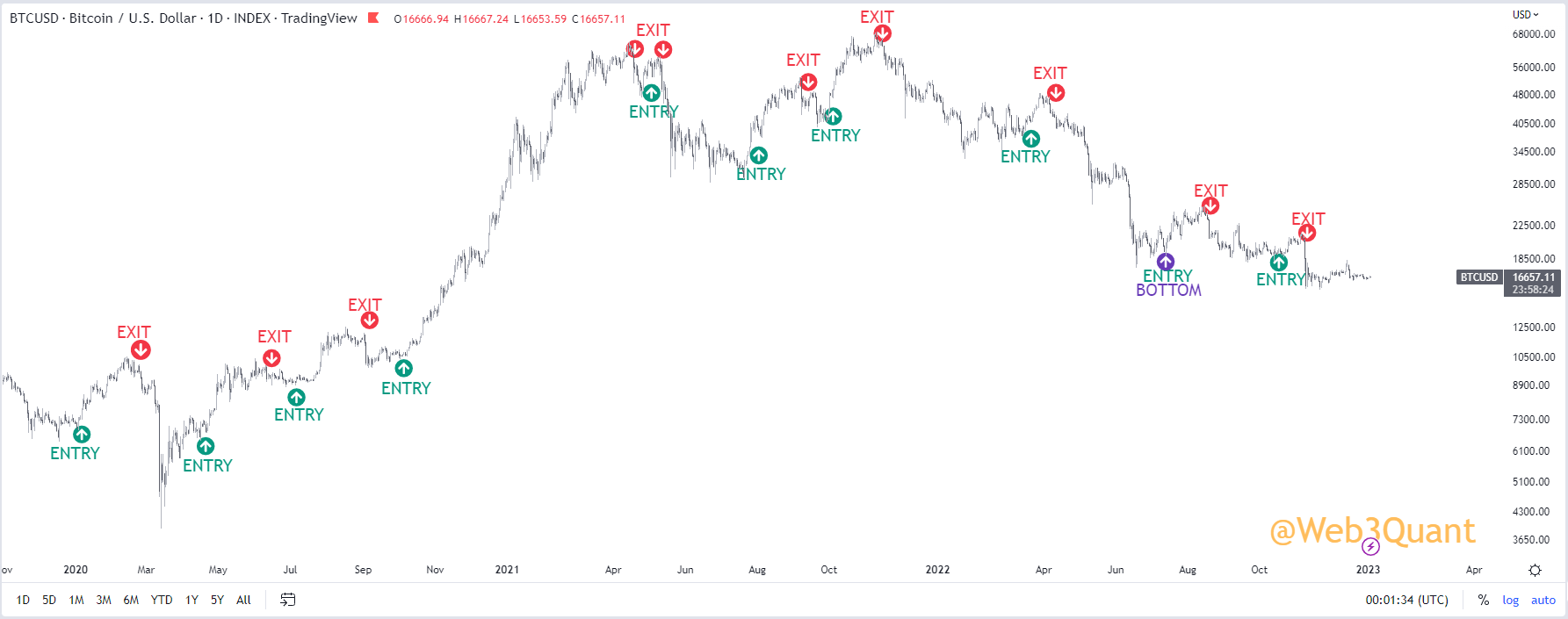

During the entire of 2022, there were only 3 high-time frame breakouts (as seen on BTC/ETH charts) and bear rallies. Model was able to go long and capture all 3 of them.

Signaled a timely exit when the bear rallies ended. Sat on 100% cash and protected capital from the downside.

Signaled a Sell in ETH well before the Merge when the entire space was bullish.

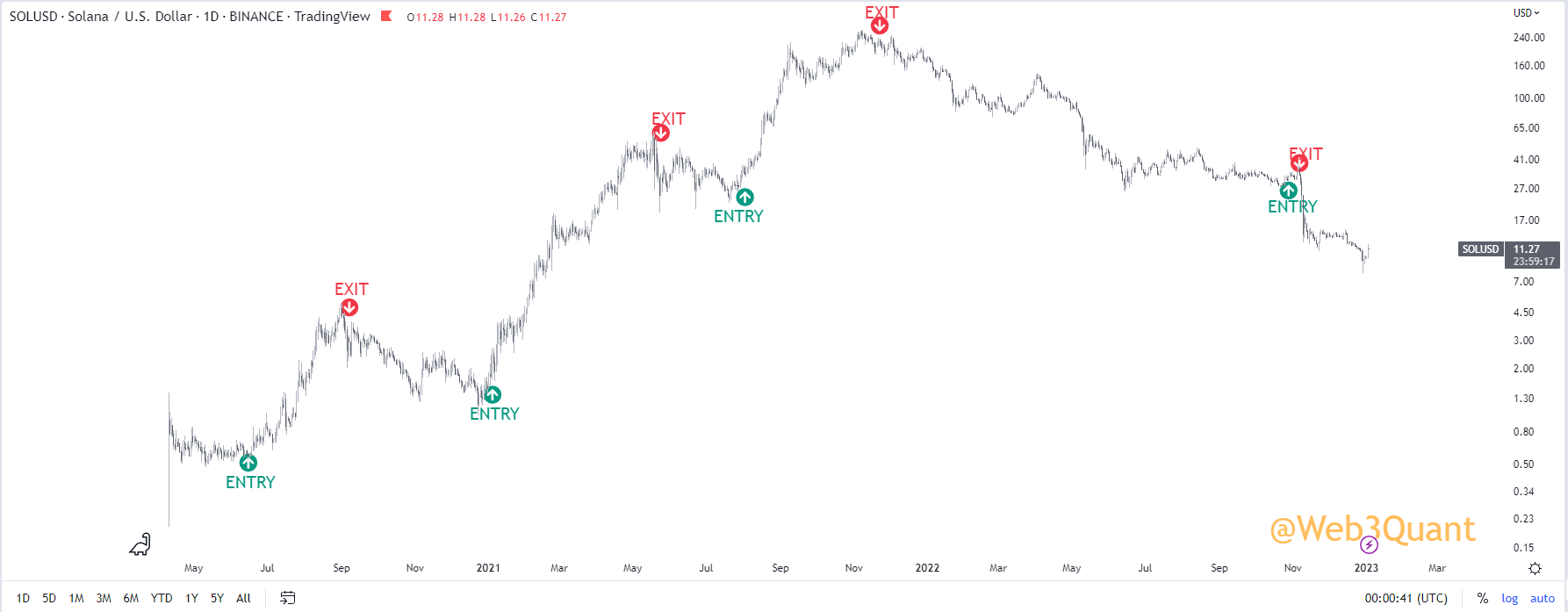

Signaled a Sell in SOL BEFORE the FTX collapse when it detected a breakdown.

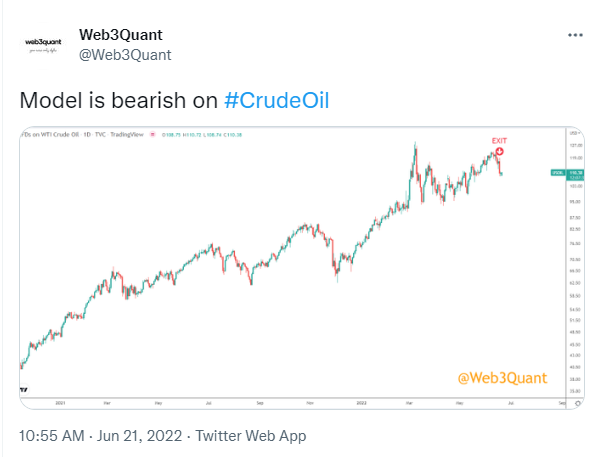

Called the TOP in Oil went Short at $115.

Caught US Dollar moves both on the way up and down.

Caught the interest rates moves both on the way up and down.

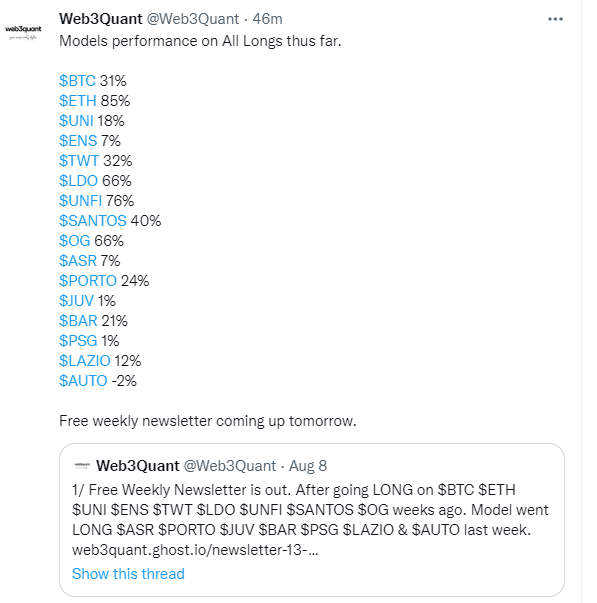

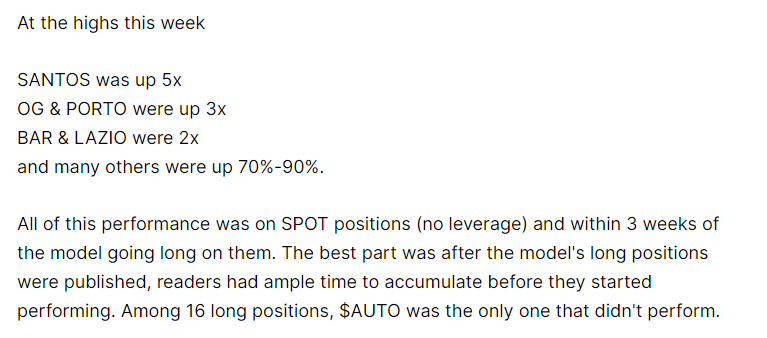

Caught explosive moves in Alts, its Fan-token picks were up multiple X and many others Alts that it went long on were up 70%-90%.

Models biggest strength is its consistency and reliability.

Model is unbiased and signals bullish as well as bearish as the conditions unfold.

The performance that you are seeing is ALL the calls made by the model and NOT selective winning performance, which shows it has delivered a very high Hit rate.

All past performances can be seen here.

Web3Quant Model went public in May 2022. Since then all signals from the model have been posted on a weekly basis on this site and on the Twitter account. And can be easily verified.

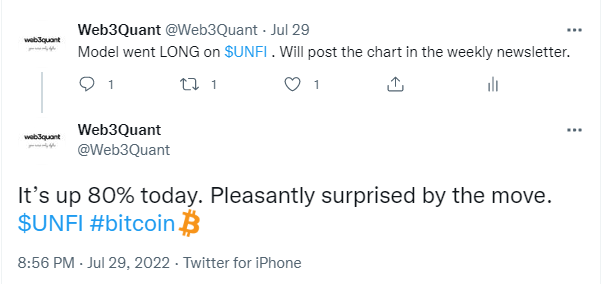

As seen on every weekly update, the model stayed in 100% CASH till July 2022. It signaled that the June low was the bottom for Crypto and Went long $BTC and $ETH and a bunch of Alts.

It was able to capture explosive performance in some of the Alts. It's not a Typo.

Model went Bearish on Interest Rates and was able to capture the bulk of the move there too.

It went SHORT on Crude Oil at $115 levels when the Ukraine-Russia War was at its peak and the mainstream narrative was that Oil was going to $200. It was a successful call and Oil moved to $70.

Model was able to capture explosive performance in many of its picks. The only failed call was $AUTO as seen below.

As you can see here below was the performance from the Models Fan Token Picks. Same time it also went LONG on $DXY.

Next week, it went into 100% cash again in August 2022 when it detected ominous Macro conditions. Models bullish $DXY call did really well then.

Model also Signaled bullish $VIX at 20 which went on to go 78% higher within weeks.

Back then the biggest narrative in the market was the FED pivot. A lot of gurus were calling for the FED Pivot soon when I published the article "Why Fight the FED". The FED still hasn't Pivoted.

Model had turned bullish on US interest rates too.

Model continued to sit on 100% CASH. This was the time when everyone was Giga bullish on the ETH merge and was expecting ETH to go up a lot. The model continued to maintain SELL on ETH almost a month before the merge and got the call right.

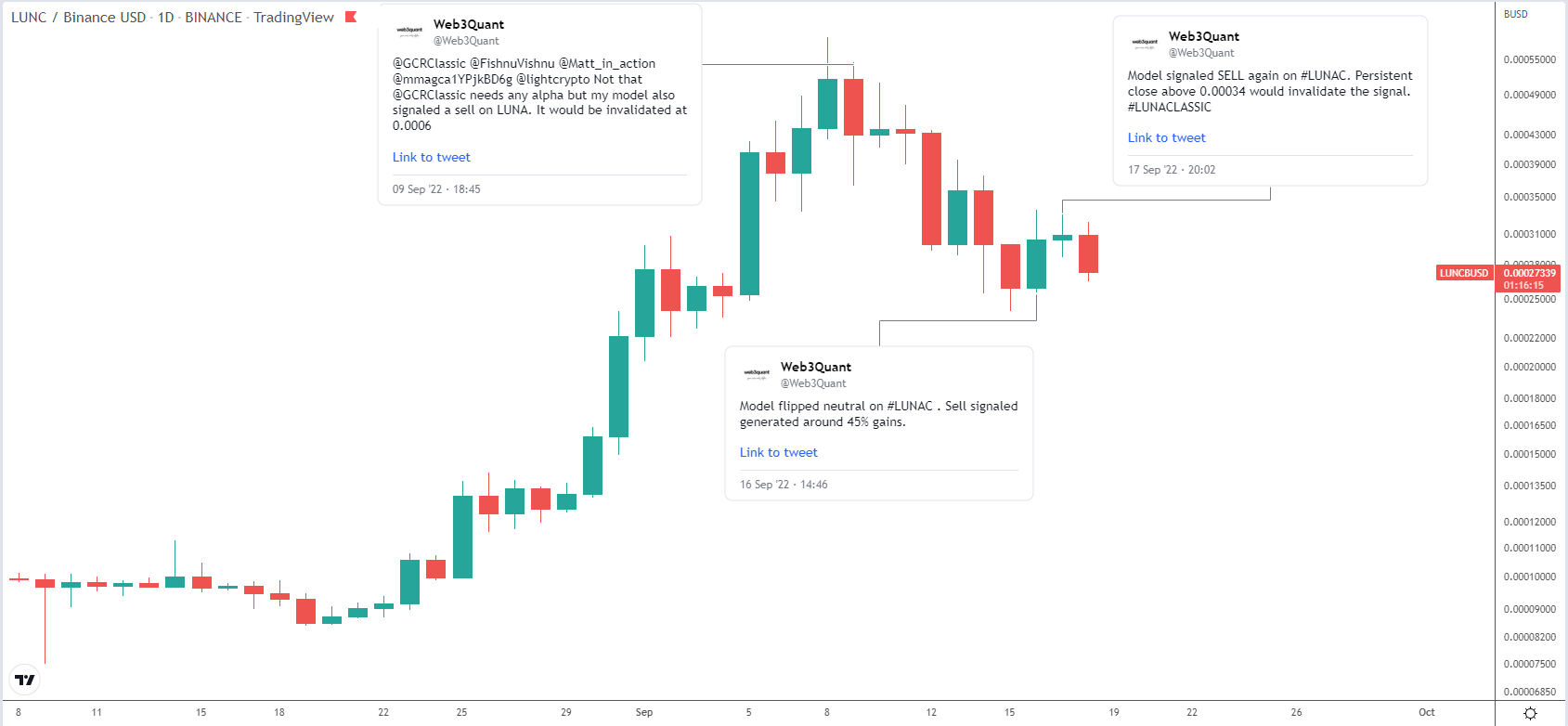

Model also signaled a timely short on $LUNC.

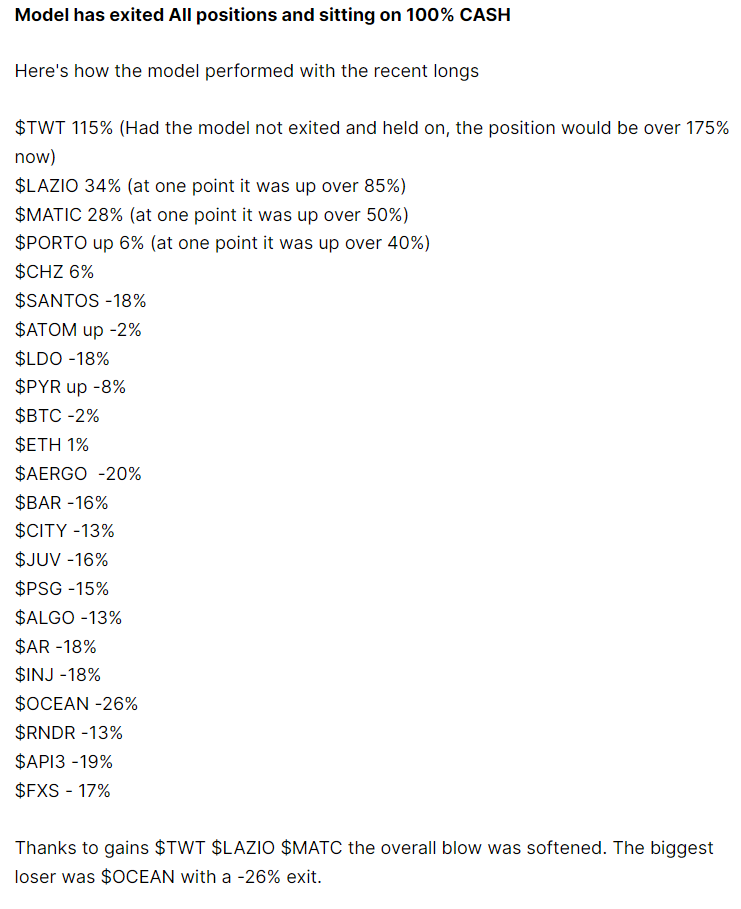

Model stayed in 100% CASH till Oct. It went long BTC ETH and a bunch of Alts.

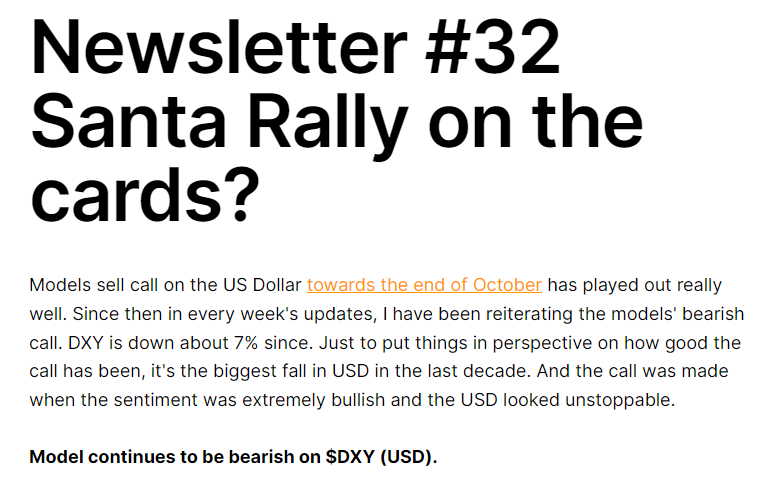

Model then also turned bearish on DXY which turned out to be the TOP of US DOLLAR.

During that time it also went long SOL (for the first time since Nov 2021) again. SOL moved up quite quickly after the model went it, models position was up about 28% when this FTX situation started brewing.

Model exited SOL with 6% gains which turned out to be one of the best calls. Next week after the exit, FTX situation fully got exposed and SOL tanked 60% in a week.

FTX was the rarest of the black swan event (if there is such a thing). When the situation was unfolding, I sent out a Market Update on how to scale out of positions.

Early Nov the model again went into 100% CASH and Continues to be in CASH to date.

Below are all the signals from the Model on BTC SOL and ETH.

** Web3Quant is not registered with any financial regulatory agencies. Web3Quant is purely a research publishing firm and does not provide any personalized financial advice. Do your own research and consult your financial advisor.**