Newsletter #17 Why fight the Fed?

A lot of smart folks are currently making the bet on the FED pivot.

It seems a perfectly logical thesis too considering that inflation has potentially peaked? growth is slowing down and there could be a recession around the corner. So the FED would be "forced" to abandon its aggressive rate hikes and restart its accommodating policies in order to secure a soft landing for the economy.

Everyone knows when the Money printer goes brrrr, Stocks & Cryptos do really well.

After the Great Financial Crisis in 2008, when the FED started its Quantitative easing program, many such smart folks said something similar that the FED can't just be printing money and keep kicking the can down the road. Those folks missed one of the best bull runs that followed.

The only thing common between folks then and now is that they both neglected a simple but time-tested rule, DON'T FIGHT THE FED.

If that rule worked on the way up, it should work on the way down too. Best not to let your bias get in the way.

Markets can stay irrational, longer than you can stay solvent.

In my experience over the years, I have found it a lot easier to take positions when the trend is in your favor rather than preempt one. Sure, you do miss catching absolute bottoms but avoid a lot of minefields in the process too.

Being too early is the same as being wrong.

If and when the FED decides to pivot, there would be footprints all over the place and it would show up in the most important macro variables such as the interest rates, and the US dollar. Right now both are not showing favorable signs.

Models bullish call on DXY has done well so far and it continues to be bullish on the king dollar.

Last week the model also flipped from neutral to bullish on the interest rates (US10Y).

Models VIX call has done really well since it went bullish at 20 levels. VIX is up around 30% since then. Model continues to be bullish and projects further upside.

Lastly, VIX which is currently at 20, has been coiling last many weeks, and the model is picking up signals that VIX could have sharp upward movement.

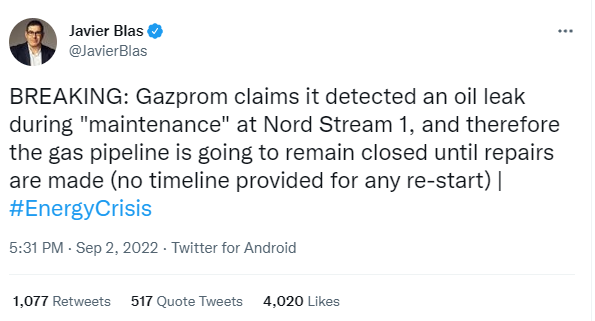

Next Crude Oil, model has flipped from neutral to bearish again. This is really interesting considering the news that came out last week. Maybe the markets haven't priced this in and the model could be wrong. We will find out soon.

Models bearish call on S&P500 and Nasdaq100 has done well too. Both indices have had a big down week. The model continues to be bearish.

Model is sitting on 100% Cash currently. It will continue to be bearish on risk assets such as Crypto, S&p500 and Nasdaq100 till the risks subside.

Bullish DXY + US10y + VIX is a very potent combo. It usually doesn't bode well for risk assets.

While SPY & NDX took a beating this week, both BTC and ETH held up relatively well. Is it a start of a new trend? Well, it's too early to tell. Model would need more positive data and confirmation to go long crypto again.

The biggest advantage of a good model is that it has NO bias. If there were to be a magical catalyst that appears out of nowhere next week, sending all the risk assets higher, the model will swiftly go long without hesitation. While anything is possible, we are in the game of probabilities. For now,

The model continues to sit on 100% cash.

Is there a silver lining at all? Well yes, Bitcoin and Ethereum are entering the value zone, if we do get a market-wide sell off then it would be a great time and price to accumulate these assets for those who believe in this space.

Below is the updated chart of Bitcoin, Ethereum & Solana with Models signals from 2020 to date.

** Web3Quant is not registered with any financial regulatory agencies. Web3Quant is purely a research publishing firm and does not provide any personalized financial advice. Do your own research and consult your financial advisor.**