Market Update

On a chaotic day like today, I felt it was important to make an exception and send out a market update rather than wait for the weekly schedule.

As I have always maintained, none of it is financial advice. I will lay out how I am playing this, you should DYOR etc etc.

In the last update, I wrote

When crypto bros hear the word LUNA, SOLVENCY, and "balance sheet concerns" PTSD kicks in really hard which led to a sell-off.

I do not have any views on FTXs solvency and just hoping that this is a nothing burger for the sake of cryptos stability. One more debacle (FTX is no minnow either) would really hurt the industry overall. As I write this the drama is still unfolding

As I write this the drama just got bigger, theres rumors FTX has halted withdrawals. And there's radio silence from FTX and Sam.

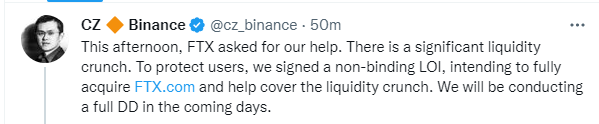

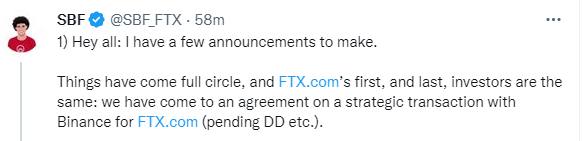

I had gotten to this point in the update when the below news broke out

Anything I say from here on will be with the benefit of hindsight but nevertheless, here we go.

I will NOT pretend and say, I was always confident there was nothing to be worried about. FTX was going to be fine Bla bla bla. In fact, I was really nervous because incidents like this make the entire crypto industry look like a clown circus. Regulators are gonna love this. Be prepared for more scrutiny.

However, one thing I was confident about was, CZ is an astute businessman. He's proven that time and again. Binance has had so many headwinds in so many jurisdictions. Still, they are roughly bigger than everyone else combined. That does not happen by accident. It's not in CZ best interest to let the entire industry fail where he's got his multi-billion $ empire.

So my thesis was, he perfectly orchestrated this sh*t show to not only send a message to Sam to show whose boss but also scoop up some stake in FTX at a discounted price thus cementing his position further.

But he went ahead and bought the whole damn thing! Who would've thunk!

Its not really a done deal though, it can fall off during due diligence or regulators could throw spanner in the works citing monopoly, etc. We just need to wait out and see it fully closed and which projects/assets are going to be collateral damage in the process.

While all this theory is well and good, what really matters is what is next.

In last weeks updates, I wrote the below

But hope is not a strategy, we need to respond to the situation. So far there's no major break in structure but the model has made a few exits.

$SOL is one of them. Model went long Solana last week and models position was up 28% at one point. FTX/Sams's closeness to SOL has had an impact. SOL gave up almost all its gains and closed flat for the week. Model has exited the position completely for now with a 6% gain. Not ideal but managing risk takes priority. Should there be positive price action it would go Long again.

Turns out the model was right after all. $SOL has been hammered.

Most of the Models' positions were in red this morning too, not surprised given the circumstances.

For the next few days, news flow/tweets will drive the prices, both up and down.

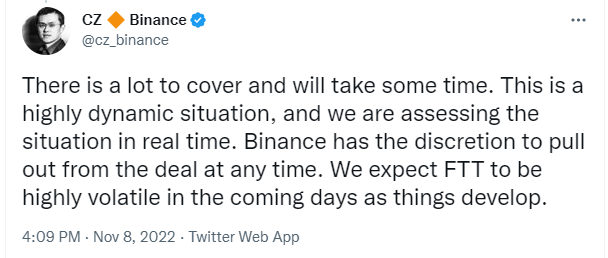

As I have managed to get to this point in the update, there's another tweet from CZ

Which has caused another round of sell-offs.

As I have mentioned many times, the model is based on trend, momentum, price action, and relative strength, so naturally, current price action has broken a lot of trend/price structures. The model is designed to tolerate volatility and it waits for high-time frame confirmations before signaling Entry/Exit. The only time it would signal mid-week is if there's a situation where there are unusual volumes and significant price drops. That's when disaster stop-loss kicks in on an aggregate level and the model would signal exit get into 100% cash. Currently, it's not kicked in but is very close.

Also, if the current price stays where they are at the weekly close, you can go ahead and presume the model would signal a Sell and get into 100% cash anyway.

Situations like today are primarily why leverage in crypto should be avoided. It's hyper-volatile as it is. Leverage just forces your hand into making a trade when it's not favorable. Anyone who was levered today was very likely wiped out.

Also, this is the reason in my faqs and posts I repeat this message constantly, that by the time the model exits on the high time frame the assets could be down 20%-30%. Thanks to CZ and SBF this is one of those situations.

Whenever there's structural damage like the one that happened today, it takes a while for the markets to recover. Also never know what other skeletons are hidden in the closet which could lead to a bigger contagion/ sell-off.

From here on out, the way I would play this is, to scale out of positions on any small relief bounces to get better exit prices as the trend and momentum are broken for the time being or to get out if the disaster stop kicks in. And would re-enter the next time there's a confirmed uptrend.

Situations like today are not ideal but one needs to be rational and respond to them as it unfolds.

Stay Safe Fam!

** Web3Quant is not registered with any financial regulatory agencies. Web3Quant is purely a research publishing firm and does not provide any personalized financial advice. Do your own research and consult your financial advisor.**