Newsletter #28 Failed breakout? or a Consolidation?

Model had a great week. Most of its longs delivered good gains. Last week I wrote the below

This week there is FOMC so one should expect some volatility around it but overall Model is bullish on Crypto and Stocks.

It pretty much played out exactly. Powell went on to be really Hawkish and the crypto responded by going lower first and then had a strong rebound on Fri onwards.

Some of the model's longs went on an absolute tear. $LAZIO was up 60%, and Matic was up 44% at one point among many others. When something is up 40% for the day like Lazio was then some profit booking and reentry at lower levels makes sense (NFA of course).

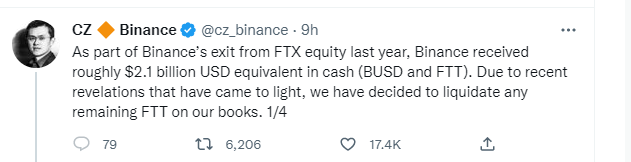

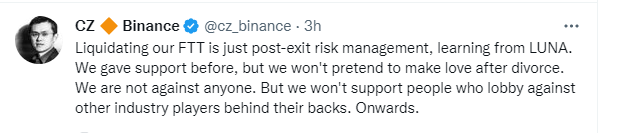

Everything was going great up until CZ Binance chose to do this on a nice Sunday Afternoon.

When crypto bros hear the word LUNA, SOLVENCY, and "balance sheet concerns" PTSD kicks in really hard which led to a sell-off.

I do not have any views on FTXs solvency and just hoping that this is a nothing burger for the sake of cryptos stability. One more debacle (FTX is no minnow either) would really hurt the industry overall. As I write this the drama is still unfolding

But hope is not a strategy, we need to respond to the situation. So far there's no major break in structure but the model has made a few exits.

$SOL is one of them. Model went long Solana last week and models position was up 28% at one point. FTX/Sams's closeness to SOL has had an impact. SOL gave up almost all its gains and closed flat for the week. Model has exited the position completely for now with a 6% gain. Not ideal but managing risk takes priority. Should there be positive price action it would go Long again.

Here's the full list of Exits.

$SOL 6%

$ENS 2%

$QNT -7%

Model continues to be long the rest and here is how of All of the model's long positions have performed so far.

$LAZIO up 39%

$MATIC up 37%

$CHZ up 29%

$PORTO up 16%

$SANTOS up 7%

$ATOM up 9%

$LDO up 10%

$TWT up 8%

$PYR up 5%

$BTC up 10%

$ETH up 19%

$AERGO down -2%

Model went long with a few coins this week. Here's the list.

$BAR $CITY $JUV $PSG $ALGO $AR $INJ $OCEAN $RNDR $API3 $FXS

Unless the FTX situation completely goes out of hand, this could be just a pullback/consolidation overall before the next up-move resumes.

Coming to Macro, last week I wrote the below

Model has flipped from Neutral to Bearish on $DXY

Model continues to be bearish.

Below are the Models signals on BTC, ETH, and Solana from 2020 to date and all the coins the model is long on. I have been publishing this every week since I went public in May and will continue to do so.

** Web3Quant is not registered with any financial regulatory agencies. Web3Quant is purely a research publishing firm and does not provide any personalized financial advice. Do your own research and consult your financial advisor.**