Newsletter #15 USD to spoil the party?

Models had a great week. Some of its picks have done really well.

At the highs this week

SANTOS was up 5x

OG & PORTO were up 3x

BAR & LAZIO were 2x

and many others were up 70%-90%.

All of this performance was on SPOT positions (no leverage) and within 3 weeks of the model going long on them. The best part was after the model's long positions were published, readers had ample time to accumulate before they started performing. Among 16 long positions, $AUTO was the only one that didn't perform.

Model exited a few positions earlier in the week.

$BTC 15%

$ETH 55%

$TWT 23%

$UNI 11%

$ENS 5%

$AUTO -11%

Model continues to be LONG the below alts

$UNFI 40%

$LDO 31%

$SANTOS 216%

$OG 89%

$ASR 36%

$PORTO 97%

$JUV 19%

$BAR 28%

$PSG 8%

$LAZIO 65%

Two weeks ago I wrote the below

So what is the model suggesting now? that we are at an inflection point which means, IF this is a bear rally then it would fizzle out within the next couple of weeks Whereas if this is a start of a new bull run then the prices would consolidate or keep creeping up higher. The model suggests it's the latter. Pullbacks are to be expected even if this is the case.

We got a sharp pullback right on cue. It was a lot deeper than expected and few risks have surfaced, hence model exited majors like $BTC, $ETH & the rest.

But you said Bitcoin Ethereum had most likely bottomed then why exit? Here's why. The model is designed to generate risk-adjusted returns. The operative word here is risk-adjusted. Simply put, some returns are not worth the risk.

But it's not the end of the world, if the risk subsides and it turns out to be a nothing-burger then the model will swiftly go LONG again on BTC & ETH in the weeks to come. If you check the model's signals on the Bitcoin ETH charts below, it did the same in June & Aug 2020 too. So there is no need to panic or call for new lows yet.

So what potential risk is the model detecting? A few of them, the biggest one being Model is bullish on DXY which historically hasn't been great news for risk assets such as crypto or stocks.

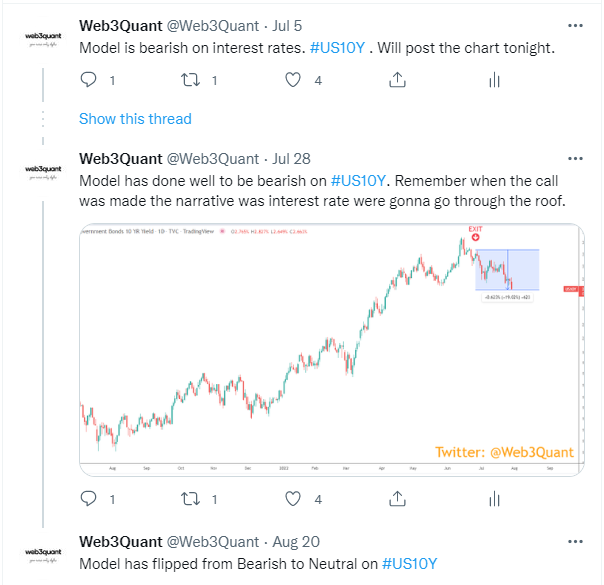

The next big macro variable is interest rates. The model was bearish on US10Y since July and it worked well. Earlier this week it turned from bearish to neutral. If the price action continues the way it has, then it's very likely model will turn bullish on interest rates. Along with a bullish dollar, higher interest rates are a potent combo.

Thirdly OIL, models bearish call on Crude Oil around the $115 area has played out well and oil is down over 20% since then. The model continues to be bearish, however, it's picking up early signs of reversal. As always, I will update you if there's a change in trend here. Oil going lower is really key, coz that helps with the inflation cooling and the FED pivot narrative, not to mention higher oil prices affect everyone across the globe in real life too.

Lastly, VIX which is currently at 20, has been coiling last many weeks, and the model is picking up signals that VIX could have sharp upward movement.

But what do these macro factors have to do with Crypto? Is it just fashionable nowadays to talk macro to sound cool? Not really, macro has always been important even if you don't directly trade them.

Let's take an example. Below is a chart of S&P 500 vs Nifty50. Nifty50 is an index that contains India's top 50 market-cap companies. Just notice the tight correlation and the returns from 2014 to date between the 2 indices. Considering how different these 2 countries are, from demographics to policies to GDP size to market-cap size, you wouldn't expect such near-identical returns for last so many years. Not to mention both these countries have gone through major political leadership changes and policy shifts etc during this period. Surely it warrants some deviation at least dont you think? I know I am cherry-picking an example here to make a larger point that markets are more correlated than you think and favorable macro is crucial for risk assets to start out performing again.

Below is the updated chart of BTC, ETH with exits, and All Cryptos that the model is currently LONG on.

** Web3Quant is not registered with any financial regulatory agencies. Web3Quant is purely a research publishing firm and does not provide any personalized financial advice. Do your own research and consult your financial advisor.**