Crypto Update: Consolidation or Distribution?

In last week's post, I mentioned this

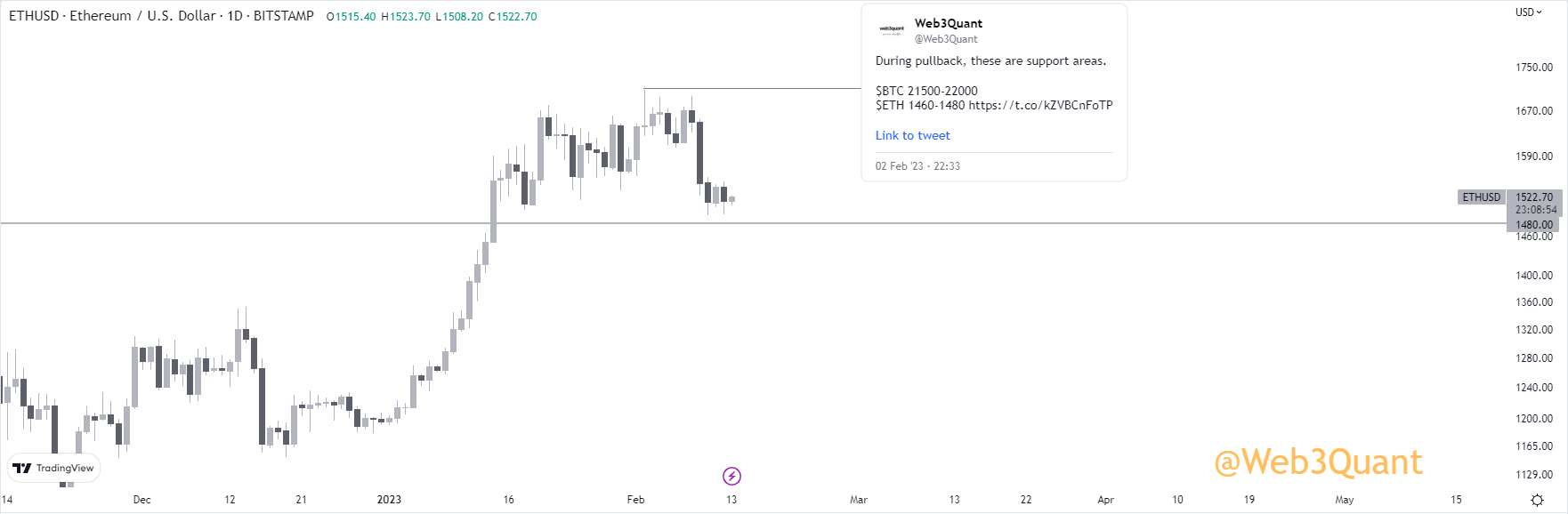

While the trend has flipped to bullish on the high time frame, everything has gone up too fast and a lot in Jan. Doesn't mean it cannot go up, just that some pullback is to be expected.

Nothing ever goes up in a straight line. Something to keep in mind before FOMOing into positions.

Lot of the names are over-extended.

We got the pullback, also they are trading at the support levels mentioned.

As I always say there's an element of PRICE and then there's an element of TIME (an underrated factor).

So far all signs are pointing towards this being a much-needed consolidation. We do NOT want to see the prices linger or deteriorate from here on out. Maybe a sharp shakeout by a wick lower, cleaning out levered folks, and then moving back up would be an ideal case.

In the last update, I also mentioned DXY

Model continues to be bearish on USD. But the move is overextended on the downside and can move up in the short term. This could cause a pullback in equities and cryptos.

It played out, DXY was up about 1% during the week.

If DXY closes this week above 105, it would open the doors for an extended pullback in Risk On Assets.

Last week was interesting for crypto, with US SEC going after Krakens staking services.

The reason it's interesting is coz while the news came out last week, Model has been long Staking Coins Lido and SSV since Early Jan.

This action by SEC makes the case stronger for such plays.

Even after so many years of trading, I am still fascinated by how markets have this uncanny ability to sniff out (if you know where to look) potential catalysts well before they happen.

Some of the Models longs have been doing really well.

All Gains mentioned are after the Longs were published. They are SPOT gains without using any leverage.

NOTE: Few of the names were up a lot more during the week, and have given up some of their gains during this pullback.

AGIX up 624% (At one point during the week it was up 10x / 987%)

FET up 189%

RNDR up 140%

OCEAN up 117%

SSV up 73%

$ASTR 41%

INJ 33%

Model continues to be Long the below coins.

$BTC $ETH $MATIC $ATOM $LTC $RLC

$LDO $SSV $FET $ELF $AGIX $OCEAN $FTM

$RNDR $VIB $PHB $LIT $IRIS $VOXEL $UNFI

$INJ $ASTR $SFP $FLUX $WOO $ARPA $PHA

Model has Exited

$SOL $RUNE $CRV $PYR $BAND $SNM $TRB

Familiarize yourselves with how the model works if you intend to follow it.

Also here is the Models Past Performance

** Web3Quant is not registered with any financial regulatory agencies. Web3Quant is purely a research publishing firm and does not provide any personalized financial advice. Do your own research and consult your financial advisor.**