Weekly Update - Crypto & TradFi

ADMIN

Enhancement to the indicator has been released and all of you should have it. Reach out to the support email if you haven't gotten it yet.

The goal always is to make continuous improvements to the systems.

Even the scanner has been upgraded in the back end.

Now that the majority of the subs have the indicator. it should allow you to make your own entry/exits on various assets more easily.

Going forward will try to give a more nuanced view of how to play the markets both for swing trades and some core positions.

If you are only after a long/short signal then you can use the indicator.

TRADFI

TradFI model went into CASH earlier this month.

While the S&P500 is holding up well and hence are a lot of good media headlines that stock markets are at all-time highs etc

the market breadth especially in the growth stocks has deteriorated.

2 stocks where you would like to see positive action are Apple and Tesla.

Apple is the perfect gauge for global consumer spending and

Tesla for retail sentiment in the stock markets.

Both are looking weak.

When the indicator flips green would be a good sign for the tradFi markets.

Anyone wishing to play TRADFI can look to long Google, Amazon, Meta, Netflix and NVDA. These are the strongest among the pack.

DXY

What's causing this pullback both in TradFi and Crypto is the DXY (USD).

It's the ultimate risk on / risk off indicator.

The good news is the HTF is still bearish and we would like it that way.

Once the short-term trend flips red here. We are likely to see a strong uptrend in both Stocks and Crypto.

its something that needs to be watched more carefully.

Crypto Stocks

No changes to what was mentioned in the previous updates. refer to it.

KR1 COIN GLXY CLSK MARA would be the core cycle picks.

For Investors - Any dips are good opportunities to add.

For traders - Use the indicator on 4-hour or shorter TF to trade in and out of positions.

CRYPTO

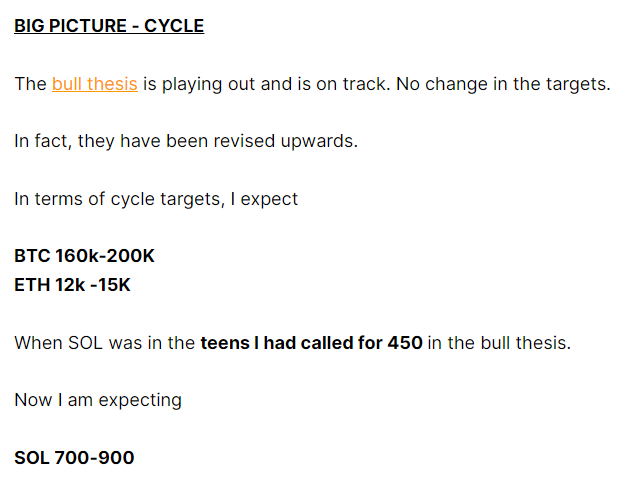

No change in big picture.

36K region is a strong support.

Any dips to those levels are a good opportunity to accumulate all core positions coz if BTC dips, everything else is very likely to dip with it.

If one is an investor then there's very little sense to move in and out of positions to score an extra 10%-15% lower entry.

as mentioned in the updates earlier.

Ignore all the news with someone tweeting X amount of inflows and outflows.

Those are just short term market adjustments.

What really matters is the biggest asset manager on the planet going on National television and promoting crypto like his life depends on it.

US presidential election candidate openly saying he's pro-crypto and issuing NFT collection.

After approving the ETF, less chance of regulators harassing the companies operating in the space.

All of this is going to bring the masses, attention, and money into crypto.

Many think they can outsmart the market and perfectly time every top and bottom. and most often end up missing the entire move.

Best not to touch core positions if you are a believer in the asset class going to much higher levels by next year.

Purely from a trade perspective. Most gurus are calling for major correction to 20Ks.

We were among the few who went bullish and that's been playing out well.

This could still be a relief rally and we could have another leg down to 36K but

What if it's not?

and we get a ripper (I'm leaning toward this scenario at the moment as we have had a strong weekly close).

we need to be open to both scenarios and be data-driven.

How to play this is the real question -

Firstly, a lot of returns can be made even during a relief rally phase of the markets and it can last for weeks too.

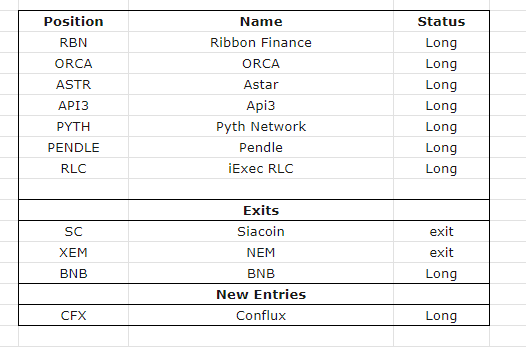

Model long alts have had a good run in the last few days. RBN API3 are up 50% for instance.

Secondly, Keep core positions as is.

For your trade positions - Getting a green on BTC and a red on DXY daily TF would indicate a nice risk on phase.

I will update you when that happens.

memes have been corrected a lot. Memes do well when animal spirits are high in the markets. When we get to that stage again. Memes will run again.

ETH - in the earlier updates I had mentioned there a strong signs indicating ETH is losing steam. it's been the weakest among majors.

If you are looking to go long then BTC and SOL or for that matter AVAX is showing resilience among majors.

its best to focus on pockets of strength than for something to turn around.

Coming to Model positions.

** Web3Quant is not registered with any financial regulatory agencies. Web3Quant content is purely for research, education, and entertainment purposes and should NOT be considered personalized financial advice. Do your own research and consult your financial advisor.**