TradFi is back too?

I always like to call things as they are but it does feel good to write some bullish updates after a long time.

TradFI Model had signaled a SELL on Equities and was sitting on CASH since September.

It managed to avoid the entire 20%-30% sell-off in the equities that followed.

The Crypto Model had already turned bullish for a while.

Model also signaled bearish on USD as mentioned in the last few updates.

Now the TradFi model has

Signaled bullish on Equities. Bearish on VIX. Bullish on Bonds.

Also if you haven't then read this update too.

Pretty much what was said here is playing out.

We are likely at the beginning of the end of this tightening stage.

You can soon expect an announcement (direct or stealth) from either the FED or BOJ (Bank of Japan) with their change in stance.

Once that happens, all macro variables will reverse aka

Dollar DOWN

Bonds UP

Stocks UP

VOLATILITY Down

FED has held the interest rates steady in the last 2 meetings. This gives ample room for other central banks to ease/inject liquidity.

China is already in major stimulus mode. Expect Japan and Europe to follow.

All of this action will be reflected in Risk-On assets.

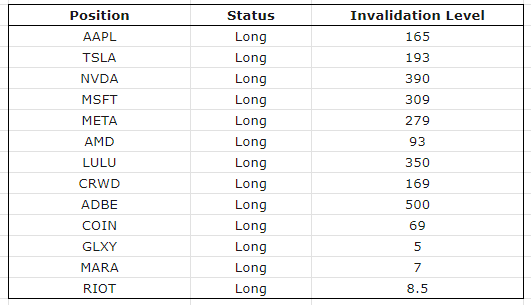

Coming to positions

Model is long majors with invalidation levels.

SPX - 4100

NDX - 14000

** Web3Quant is not registered with any financial regulatory agencies. Web3Quant content is purely for research, education, and entertainment purposes and should NOT be considered personalized financial advice. Do your own research and consult your financial advisor.**