Crypto & TradFi Update

Let's address some housekeeping questions first.

- As mentioned in the improvements to the model post.

Updates are NOT limited to weekly only. You will receive it as needed, sometimes multiple times a week too. However, if there is no change to positions or updates during the week, ONLY then you will get a weekly update on Sunday night regardless. - Coins selected for longs tend to be primed for breakouts and would have high momentum behind them.

If you get a 30% pop in a single day or a 100% move in a week. Do NOT wait for the next update. Just book some profits and renter again on lower levels.

Those who miss the move, DO NOT FOMO, wait for some cool-off before entering. Every single coin has had several 20%-30% pullbacks even during its 50x-100x journey.

Meme coin XRP was a good recent example. It moved up over 100% in a couple of days after publishing and gave back all its gains.

Let's do Tradfi first.

TradFI model has been sitting on CASH since Sept.

Model has signaled a SELL on Equities and is sitting on CASH.

Macro is looking ominous. USD still showing relentless strength. Bonds continue to be weak. VIX is threatening to break out.

This potent combo has usually resulted in an ugly down-move in the past.

It would make sense to buy some short-term insurance through PUTS.

The only thing the model continues to be bullish is commodities - Oil.

Everything mentioned above has played out pretty well.

When the above update was released there were absolutely no signs of any geo-political tensions. In less than a month, we are staring at a potential WW3 situation.

Billionaire investor Ray Dalio said there's a 50-50 chance a world war will break out in light of the Israel-Hamas conflict.

It's sad to see what happening in the Middle East but purely from a model standpoint it's delivered and kept us out of trouble.

In the short term, volatility will be high as it's hard to predict which country would do what in such circumstances,

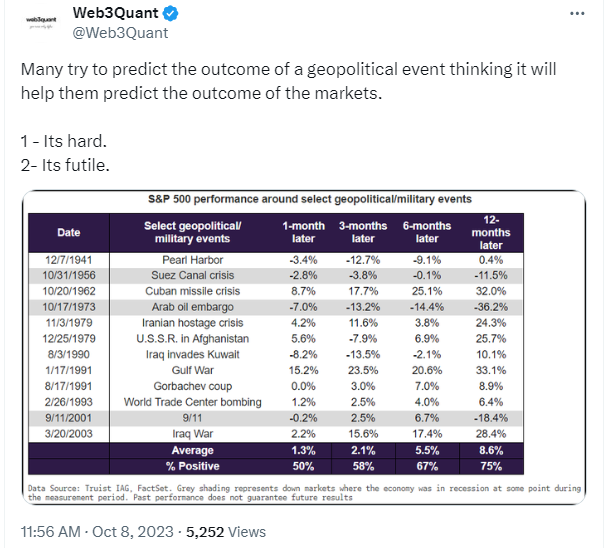

but as an investor, it is always good to remember the below.

So what's next?

Everything mentioned in the last TradFi update is still relevant.

We are likely at the beginning of the end of this tightening stage.

You can soon expect an announcement (direct or stealth) from either the FED or BOJ (Bank of Japan) with their change in stance.

Once that happens, all macro variables will reverse aka

Dollar DOWN

Bonds UP

Stocks UP

VOLATILITY Down

But it's always good to get confirmation. We will get it in the PRICE and Volumes first and the footprints will be all over the place. Model will detect it.

That would be the time to go LONG.

Things were already stretched and we are at the end stages of the FED tightening cycle. If anything this Geo-political situation gives them more room to inject liquidity sooner to support the markets (should it plummet).

As always, while everyone watching the outcome of the war situation, we will only be following the money.

Till we get confirmation model continues to sit on CASH.

The only thing bullish in the TradFI space currently is Oil with an invalidation of $80.

Next up is Crypto

Its crypto after all, so volatility is a feature, not a bug. Remember volatility is different from risk. Learn to identify and separate the two.

Considering what's happening in the Middle East we could get a dislocation event.

Just like we got in 2020 during covid when all risk assets tanked sharply. Those are hard to predict but if we do get it then that would be the time to go allocate 100% into longs without leverage.

The probability of a FED intervention and liquidity injection becomes almost a certainty.

If you haven't already then do read the crypto bull thesis. It has the entire thesis with catalysts, picks, and projections for the next cycle.

TLDR - Purely from a value standpoint, it is a good time to add to long-term high-conviction holdings. We are potentially looking at a 20%-30% drawdown with an upside of over 500%-1000%.

Coming to the quant side of things

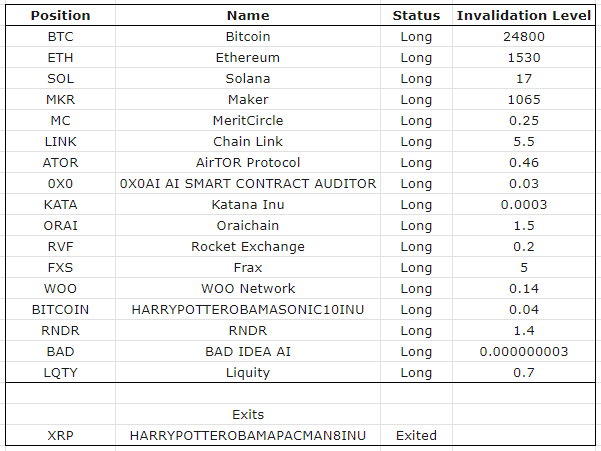

While the TradFI model signaled a SELL, the crypto model has stayed long.

Earlier this year there were many instances where the TradFi was long and captured big moves in the likes of NVIDIA, Tesla, etc while crypto stayed in CASH.

This further showcases that correlation is not causation. And each market should be traded on its own flows.

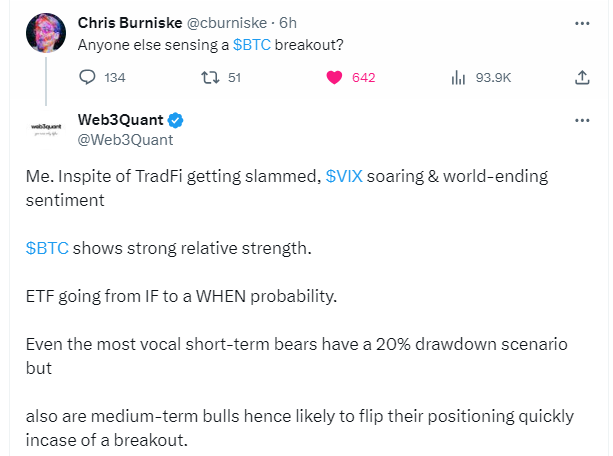

Earlier today I wrote this on Twitter. This still remains the view.

While the majors are yet to make big moves.

The bulk of the action remains in the Alts space. Some of the Model longs have been on fire.

The longs published since the Model went long last month

These are SPOT gains, without any leverage.

0x0 is up 160%

ATOR is up 95%

RVF is up 90%

LQTY up 50%

Maker is up 40%

MeritCircle up 20%

ORAI up 15%

Even during the most challenging period of crypto and in the midst of a brutal bear, model has been able to sniff out both on-chain & CEX-traded coins, across the market-cap range.

All we need is a bit of momentum in the market.

Even if you are not trading some of these smaller on-chain names, it would be good to prepare with your setup, validate how and when the model goes long & exits, and build conviction.

When we do get bull run, a lot of 50x-100x will come from this space.

Coming to Model positions

** Web3Quant is not registered with any financial regulatory agencies. Web3Quant content is purely for research, education, and entertainment purposes and should NOT be considered personalized financial advice. Do your own research and consult your financial advisor.**