TradFI update

Models call is playing out. Sitting on CASH while the carnage is playing out.

As mentioned in the previous updates

Crypto Markets have really picked up but TradFI still has some work to do. BONDS continue to look weak.

DXY and OIL continue to look strong.

And earlier...

Both SP500 and Stocks have been taking it on the chin.

Even VXX (Volatility ETF) is up over 25% since.

Folks who bought PUTS/insurance as mentioned in the update would have done well.

What next from here? Below are the 2 most important charts for ALL markets.

As you can see USDJPY has gone on a tear. Its up 45%. That's crazy in forex terms.

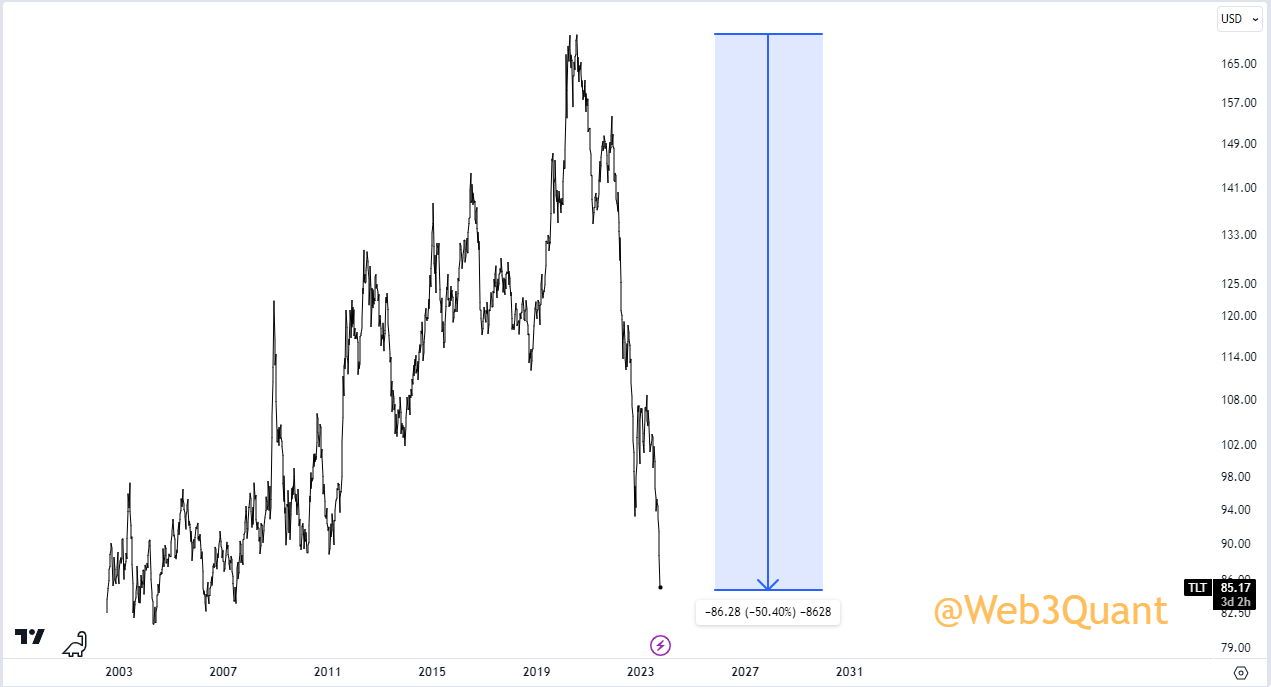

Also, Bonds (TLT) which are generally considered safe investments are down over 50%.

Typically how it works in politics, life or any government intervention is

If they proactively acted and came and told you.

"Hey look I fixed it already and avoided a catastrophe" Would you believe them?

NO.

Also, they need to justify their action to a lot of armchair analysts, media, etc.

But if the Sh*t hits the fan THEN they fix it. Not only become the hero but also they can do it with minimal resistance from any part of the gov, opposition or media etc.

So what to expect next?

We are likely at the beginning of the end of this tightening stage.

You can soon expect an announcement (direct or stealth) from either the FED or BOJ (Bank of Japan) with their change in stance.

Once that happens, all macro variables will reverse aka

Dollar DOWN

Bonds UP

Stocks UP

VOLATILITY Down

But it's always good to get confirmation. We will get it in the PRICE and Volumes first and the footprints will be all over the place. Model will detect it.

That would be the time to go LONG.

** Web3Quant is not registered with any financial regulatory agencies. Web3Quant content is purely for research, education, and entertainment purposes and should NOT be considered personalized financial advice. Do your own research and consult your financial advisor.**