Positions Update

Yesterday I released a Web3Quant indicator how-to guide to address many of the FAQs.

if you have some more questions then send them across will address them in the updated version.

also, I have a few new initiatives that I have been working on. will make the announcement this week regarding the same.

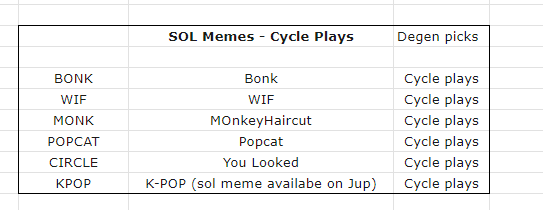

Our Solana meme plays have been on fire.

in less than a month

WIF has done over 35x.

Popcat over 5x.

Circle about 10x.

continue to be bullish and these are looking good for a lot more.

newest entry on Sol meme is KPOP.

NOTE: Going forward will NOT be tracking them along with the trend model updates

as these cannot be purely played via trend models and the price is a lot more volatile.

sometimes even 90% drawdown before they do 10x-20x.

also, it confuses a lot of subs and many cannot differentiate between value and momentum despite tons of explanations.

treat meme picks as zero or hero cycle plays.

Don't get involved if it's too much volatility for you to handle.

book profits as you see fit.

will periodically provide updates as needed on them.

I've mentioned this in the past too but worth reminding.

sometimes value and momentum can be contradictory to each other.

Example: You could have a value thesis that Bitcoin will touch 100K but

your trend system might enter and exit multiple times during that journey.

That is why one is better served by formulating allocation strategies for each style.

Core positions could be via value and trades can be expressed via trend systems.

Many reputed folks in the space are calling for correction.

after such a one-way upmove, it's logical to expect a pullback.

So there's nothing unique there in fact "sell the news" is now the consensus.

Calling it means nothing. What really matters is how are you playing it.

We could potentially have a 10%-20% pullback and sideways move for a while yes

but from a cycle standpoint

I firmly believe that dips are for accumulating core positions.

one could sell if they want to lock in gains and trim some positions or are bearish but if you are selling only to buy back lower little lower, then it could potentially backfire too.

as we have a lot of catalysts primed and even one of them can extend the rally.

most of the targets mentioned in the bull thesis are on track. infact some of them have gotten better.

One of the reasons I am holding back on publishing the update to the bull thesis is that some of the coins I think will be no-brainers for the cycle have not launched yet but should be soon.

From a trend standpoint, we still haven't gotten a sell confirmation yet although its been a sharp down move the last few days.

You could use 40K as the invalidation for BTC.

Meanwhile, the BTC Dominance uptrend is firmly broken. this presents a good scenario for a ripping alt season.

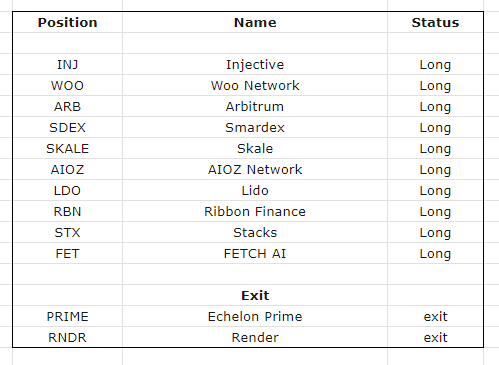

Model continues to be long BTC, ETH SOL

Coming to other positions there have been 2 exits.

** Web3Quant is not registered with any financial regulatory agencies. Web3Quant content is purely for research, education, and entertainment purposes and should NOT be considered personalized financial advice. Do your own research and consult your financial advisor.**