Time to Long your Longs?

It's been a phenomenal turnaround in the markets.

In the last update, I wrote this

Why do closing prices matter more than intra-day or intra-week prices?

They are a more reliable indicator of a trend as the markets get enough time to digest the news and show us the true direction where it wants to head next.

Yes, at times you do lose some meat on the move waiting for confirmations. but it also saves you from whipsaws and shakeouts.

This is why the weekly strategy is so powerful. It helps you stay in the game and ignore the news even when it seems like the world is about to end.

Those who follow me on Twitter would know that model detected the bottom and the turnaround.

Those were published even when some of the heavyweights on Twitter were calling that the rally is over.

The model even detected the turnaround in the interest rates.

Even FED's current action to step in was mentioned beforehand.

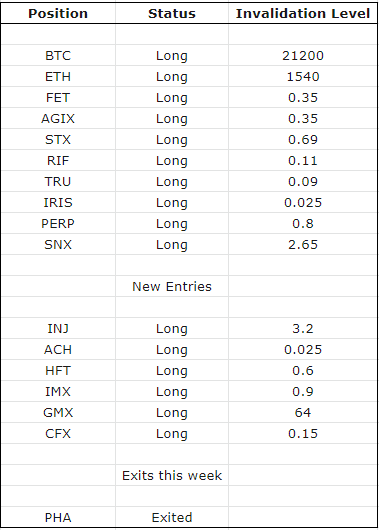

Coming to the Model Positions

It's time to play offense.

There has been 1 exit and 6 new entries.

NOTE: The strategy and the invalidation levels mentioned are based on Weekly closing prices. So ideally, subsequent weekly updates would cover the Exits anyways. But for those who like to trade in and out of positions, it would be best (it's not a recommendation, just guidance) to wait for Daily or 3Day time-frame closing prices to consider.

Use the Weekly Closing Prices to calculate Entry & Exit Prices & Performance.

** Web3Quant is not registered with any financial regulatory agencies. Web3Quant is purely a research publishing firm and does not provide any personalized financial advice. Do your own research and consult your financial advisor.**