momentum waning...

while we have not gotten an HTF sell signal yet

momentum is significantly degraded across the riskON assets.

DXY also is threatening another breakout to the upside.

if this continues trend models will likely signal exits soon. will send a note when it does.

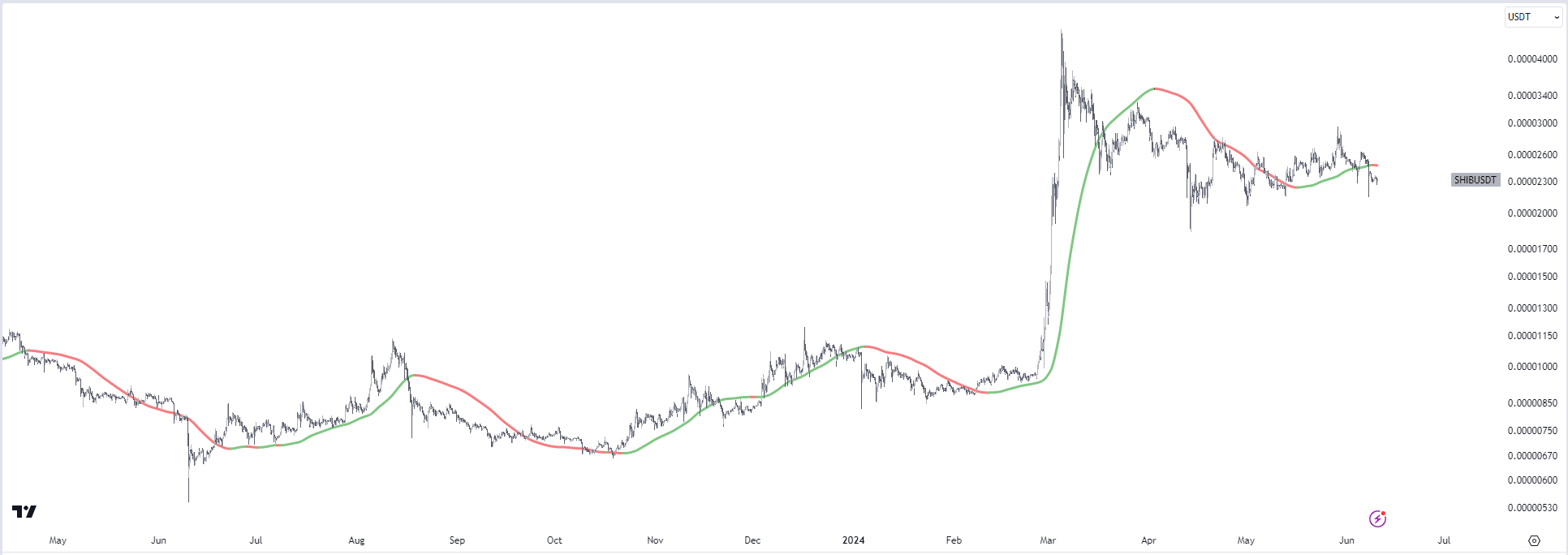

now this shouldn't be considered as all doom & gloom. we had a very similar sideways price action playout last summer too (marked in circle).

W3Q indicator will really come in handy in this situation.

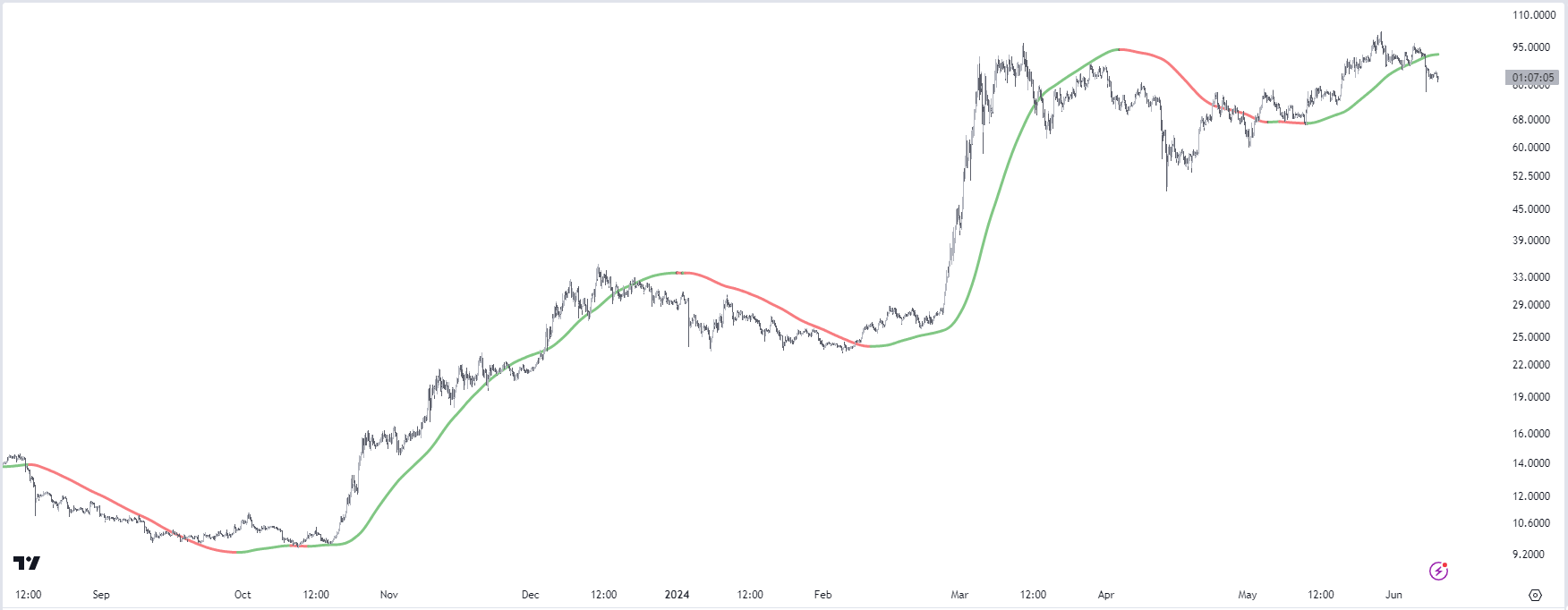

for instance, this is the latest update in the custom meme index

as you can see despite all the good news around tradfi flows into ETFS or favorable regulatory stance or big crypto acquisitions etc

the meme majors (one of the highest betas) have been lagging.

when good news doesn't lift the price and bad news doesn't push the price down, it's important to pay attention and adapt accordingly.

while you will always have the odd plays doing well data clearly shows the trend is getting bearish for now.

i have found 3h timeframe to be working well on meme majors as they are a lot more volatile.

NOTE: i have clarified in one of indicator faqs what to expect.

just like majors, it doesn't mean its the end of the story.

memes as a category are here to stay and have been a proven sector for this cycle but just like anything else they will go through periods of excesses and flushes.

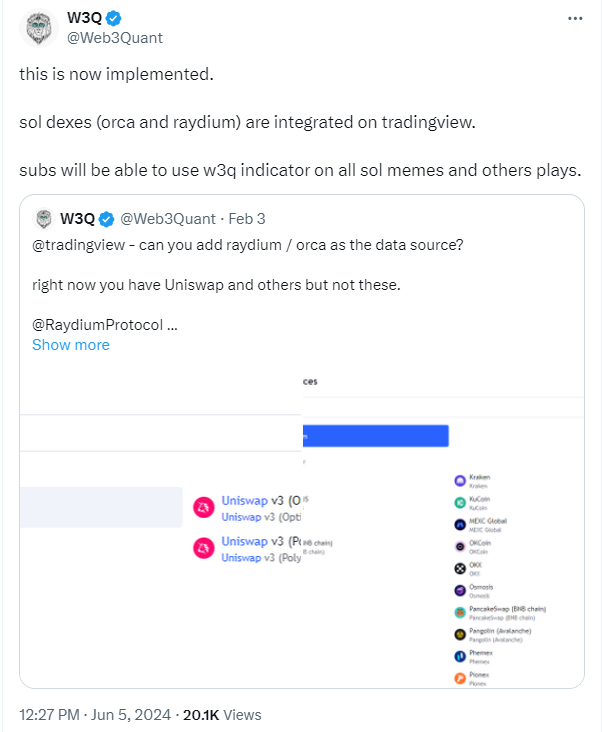

now the good news is that Tradingview has integrated both Raydium, ORCA, and uniswap (base).

this enables running the w3q indicator on all Solana and base memes too.

when the next breakout kicks in, this will help us ride all on-chain plays.

one of the repeated questions I get is "are we only focused on memes"

the answer is NO.

im only focused on trends. the scanners are designed to pick up on where the trend and money are flowing into without ANY BIAS.

this cycle has been about BTC + SOL + MEMES thus far. Anyone whose not been into these has not made much return.

but if the sol or meme trend is over and utility coins are back in demand we will pick those up too just like we did previously

coming to how one could play this

if one is a long-term big-picture investor only dealing in spot then do nothing and riding makes the most sense.

from a positional trades perspective playing defense by derisking on your high-risk plays or any leverage till we get a breakout would make sense.

if we do get a big flush then it would be a good time to add to high-conviction plays.

for crypto, it would be majors BTC, ETH, and SOL.

for crypto stocks, it would be COIN, GLXY, MARA, and CLSK

for memes following the trends (w3q indicator is one of the ways) makes the most sense.

so what will change for us to be bullish short term again?

BTC breaking weekly above 72K or we get leg lower and then breakout from the value zone. as always will send a note as and when we get those.

ideally, we would have loved a summer breakout and all the setups were indeed pointing towards it but we need to respect the data as it unfolds.

Here's the silver lining to all this, by having a longer consolidation and the climax kinda move it has extended the life span of the bull cycle.

see you in the next one.