major upgrades — every module rebuilt

We’ll cover

- What changed

- Why it matters

- What you’ll notice (results)

WHY first

Seasoned traders work from intuitively when they see a chart ; newcomers don’t.

the fewer levers you have to pull, the faster you win.

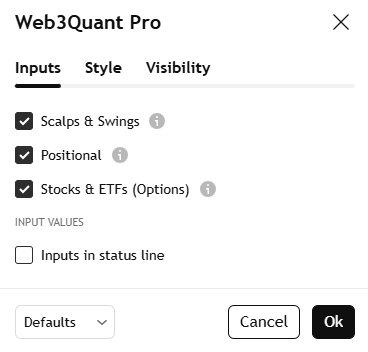

With this release you get:

- One module → one outcome. No hunting, no overlap.

- Zero tinkering. Pre-configured, visually identical arrows across assets.

- Clear path:

- Scalps & Swings – short-term trading (multi hours to days)

- Positional – medium/long term trading (multi-week plays)

- Stocks & ETFs – equity + options bias, built for US market windows

- S/R Boxes – auto support / resistance on any chart, any timeframe automatically drawn for you.

result: dip-buying and profit-taking become super easy.

How to get it (takes <30 s)

- Log out / log back in to TradingView.

- Delete the Web3Quant indicator.

- Re-add it from Invite-Only Scripts.

- In Style tab you’ll see the new Boxes checkbox—toggle S/R zones on/off.

NOTES

- 4 independent systems NOT interconnected.

- Each tooltip shows an optimised timeframe—feel free to experiment.

- They work best on heikin ashi candles.

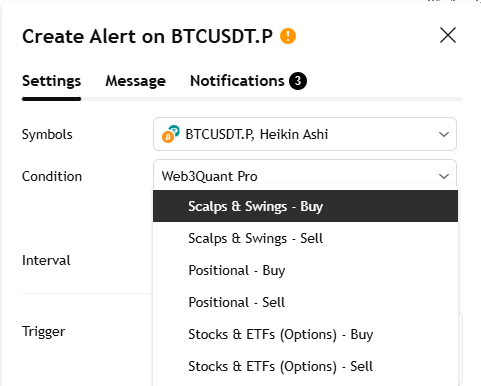

- Alerts come pre-labelled. If you want only confirmed signals, set Once per bar close and always wait for candle close.

- Wild on-chain or meme moves can cause intra-bar flashes—data noise, not repainting issue. Pros can still act on intra-candle prints.

RESULTS

lets go through the systems one by one.

1 - Auto S/R Boxes

this is probably my new fav feature.

every web3quant system is deigned to tell you without any ambiguity on when to long/short. No noise.

the one thing that was missing was where to buy the dip or where to take some chips off the table.

i have tried many variations but the one things that works better than most and is UNIVERSAL is s/r zones

i mean drawing lines is really no big deal

but when its auto drawn for you

it takes all your biases out of the picture. that for me has been a unlock.

i will write a follow up post just highlighting some of the basic techniques like liquidity grab etc you can use but

i would urge you to just run this on various charts and timeframes to get a sense of it.

you will automatically see a pattern emerging.

2- Scalps & Swing

before we had Separate Scalper + Swing engines. both were catering to similar trading persona. short term.

many were getting overwhelmed by which one to use when.

now they are Merged & throttled—cleaner arrows.

theres no visual changes than before. all changes are underneath the surface.

you will notice the signals are 20% improved but more importantly it takes away a moving part.

you will execute better.

all you need is to run through various timeframes. see which ones makes sense for your style.

give 10m/30m/2h/4/6h a spin.

3- Positional

theres been a visual change here. its aligned with the others. green/red triangles.

this takes out any ambiguity and makes it intuitive.

4- Stocks & ETF

while every other module is universal (you can trade from crypto to forex to stocks to bonds)

this is specifically designed for stocks & etfs for ultra short time frames.

those who want to trade short dated options know

its not just getting the price right you need to get it right in time else options expire worthless.

try 3m/4m/5min on SPY / QQQ / TSLA as these are the most liquid options.

NOTE: they work on all equities and etfs. just highlighting liquid ones.

will have some follow up posts with market updates.

see you in the next one.