explosive move incoming

setups look primed for a breakout rally.

the systems have been performing extremely well, catching both the up legs and the down legs.

metals first

the system exited near the top of this leg on both gold & silver.

stocks next

two retail bellwethers, HOOD and TSLA. not just good companies, they are also clean reads on risk appetite.

fresh breakouts here tend to precede a wave of retail participation.

they tasted blood on the parabolic gold and silver move, and on the stock memes. if momentum builds, capital moves down the risk curve.

system caught the entire upmove of HOOD from 30s to 140s.

crypto

the system signaled the breakout days in advance, plenty of time to position.

alts and memes are flashing strength, which is what you want to see for risk coming back. HTF charts look constructive too.

plan for the week. if we get dips, they are good spots to accumulate. the system will call the levels on your charts.

- btc

- sol

- pengu

- bonk

black swan check

the whole idea of blackswan is no one sees it coming but price/volume and whales always leave a trail.

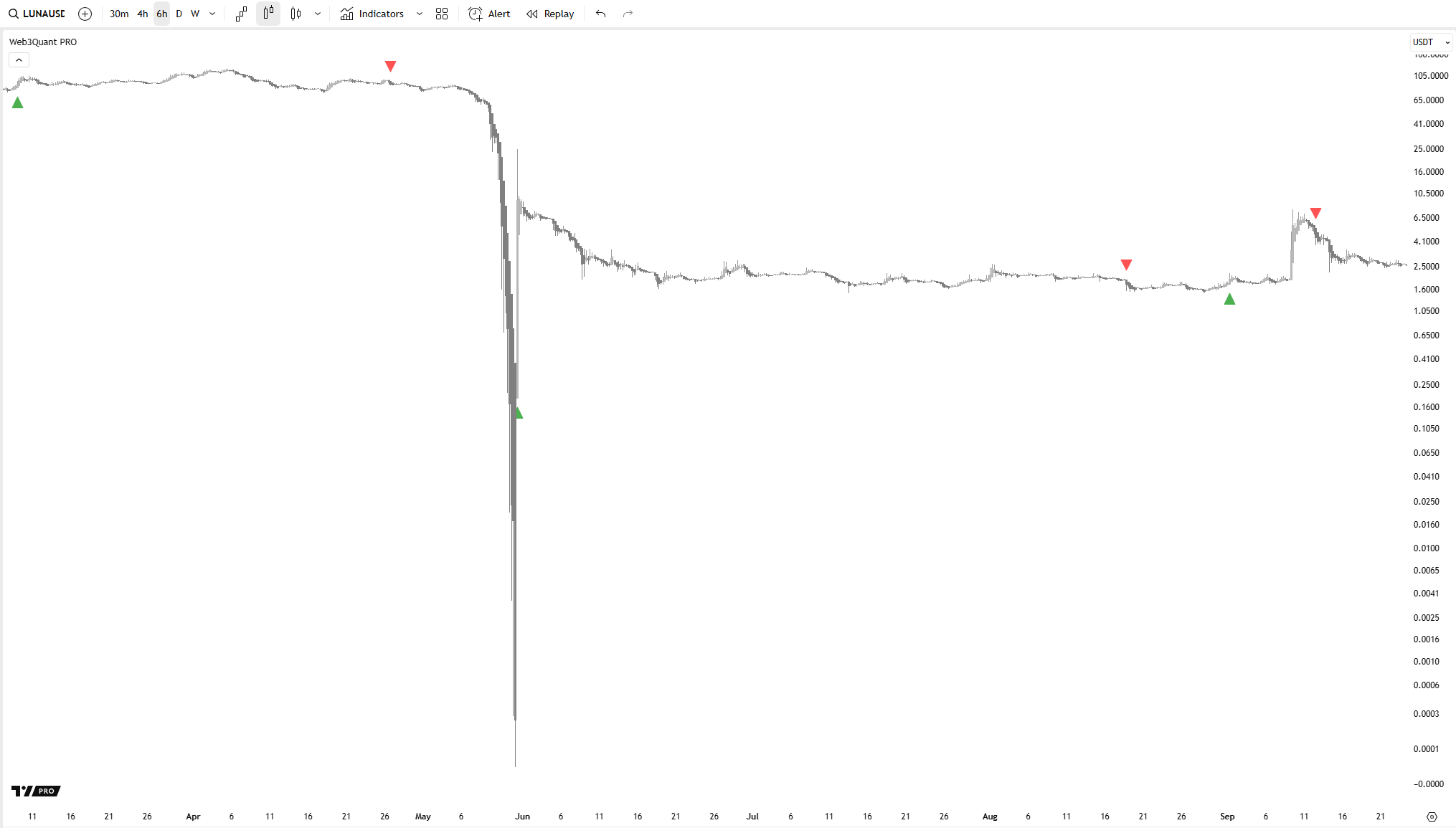

the litmus test of a system is how well it handles black swan events.

crypto sees more of them than tradfi. handling does not mean reacting on the breakdown candle.

any moving average crossover can do that.

you want early signals that let you position.

the 10/10 crash was a live example. the system did what it should.

below are four historical cases most of you remember. in each one, the system printed SELL days or weeks in advance, same as it did on 10/10.

- covid crash

(chart: BTC during covid) - ftx blowup

(chart: SOL during FTX)

(chart: FTT crash) - luna collapse

(chart: LUNA crash)

see you in the next one.