Meme & Dog Szn?

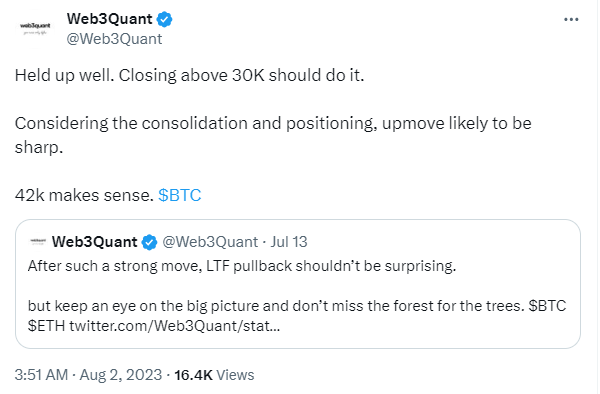

For a while been calling for 42K BTC. Today we tagged 40K.

The only bearish argument you could make is, that it's moved up too much.

Historically such arguments have never been a successful one.

If you only want the pullback to buy the dip then very unlikely to come.

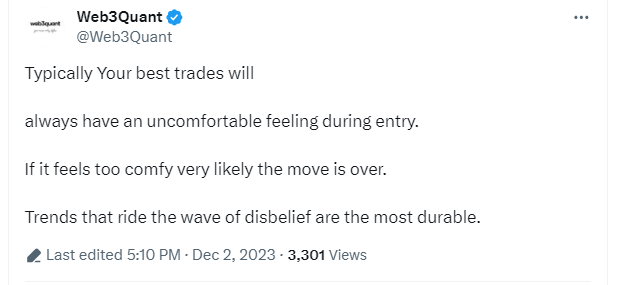

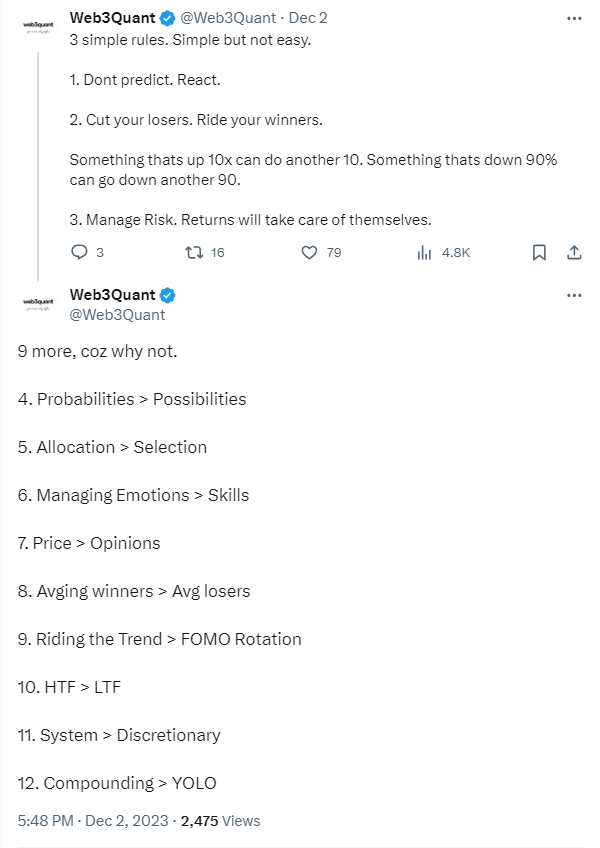

Also here are some timeless lessons I have learned over the years.

Coming to $BTC, yes the move has been strong but so is the reason.

While anything can happen aka the move could climax sooner for a variety of reasons, we will follow the data till it suggests otherwise.

We have a high probability ETF approval in Jan,

this gives a goldilock kinda situation from now till then where the

- The big 3 BTC, ETH & SOL have had a strong weekly closing.

- TradFI is supportive.

- Seasonality favors the bulls.

This is ripe for Meme season.

The bull thesis already mentioned DOGE and BITCOIN as potentials from a thesis standpoint. BONK is also a no brainer to play the rise of Solana.

Models bullish on all 3 too.

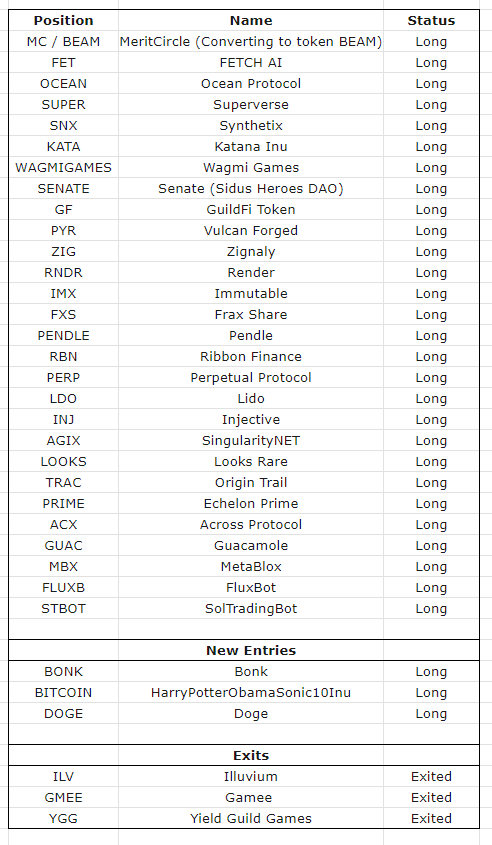

Coming to positions. Model continues to be bullish on BTC, ETH & SOL.

There are 3 entries and 3 exits.

NOTE: Mentioned it multiple times but still keep getting this question "Why did the model exit so and so, why has it not re-entered"

When the times are bullish 100s of coins pump. We cannot be long all of them. So some ranking is developed to select the strongest ones.

Sometimes there will be exits even there's nothing wrong with the coin.

Its simply to make space for another stronger potential performer

There will be times when we will miss out on some pumps, but that's part of the game. The more important question is, is the model long-performing?

Now most of you also have access to the indicator. So if you are particularly interested in some coins then you could use the tool to enter/exit without the updates.

** Web3Quant is not registered with any financial regulatory agencies. Web3Quant content is purely for research, education, and entertainment purposes and should NOT be considered personalized financial advice. Do your own research and consult your financial advisor.**