bullish markets - btc alts memes privacy gold silver.

continuing from our last update

market mechanics: bitcoin typically ranges for months, then compresses the bulk of its returns into a 6-8 week trend window. we are likely entering one of those windows. this is the time for "risk on."

ALTS & MEMES beta is waking up. most energy should be spent identifying the runners here, then using the system for entry/exit precision.

the pivot: system flipped LONG on dec 29th, pre-empting the current move. we are currently riding.

things looking constructive. even HTF systems are curling up.

let’s look at how the system is navigating the sectors.

MACRO (GOLD & SILVER) while crypto chopped, commodities trended. the system played these clinical. minimal drawdown, maximum capture. when the trend is clean, you don't overtrade it. you just hold.

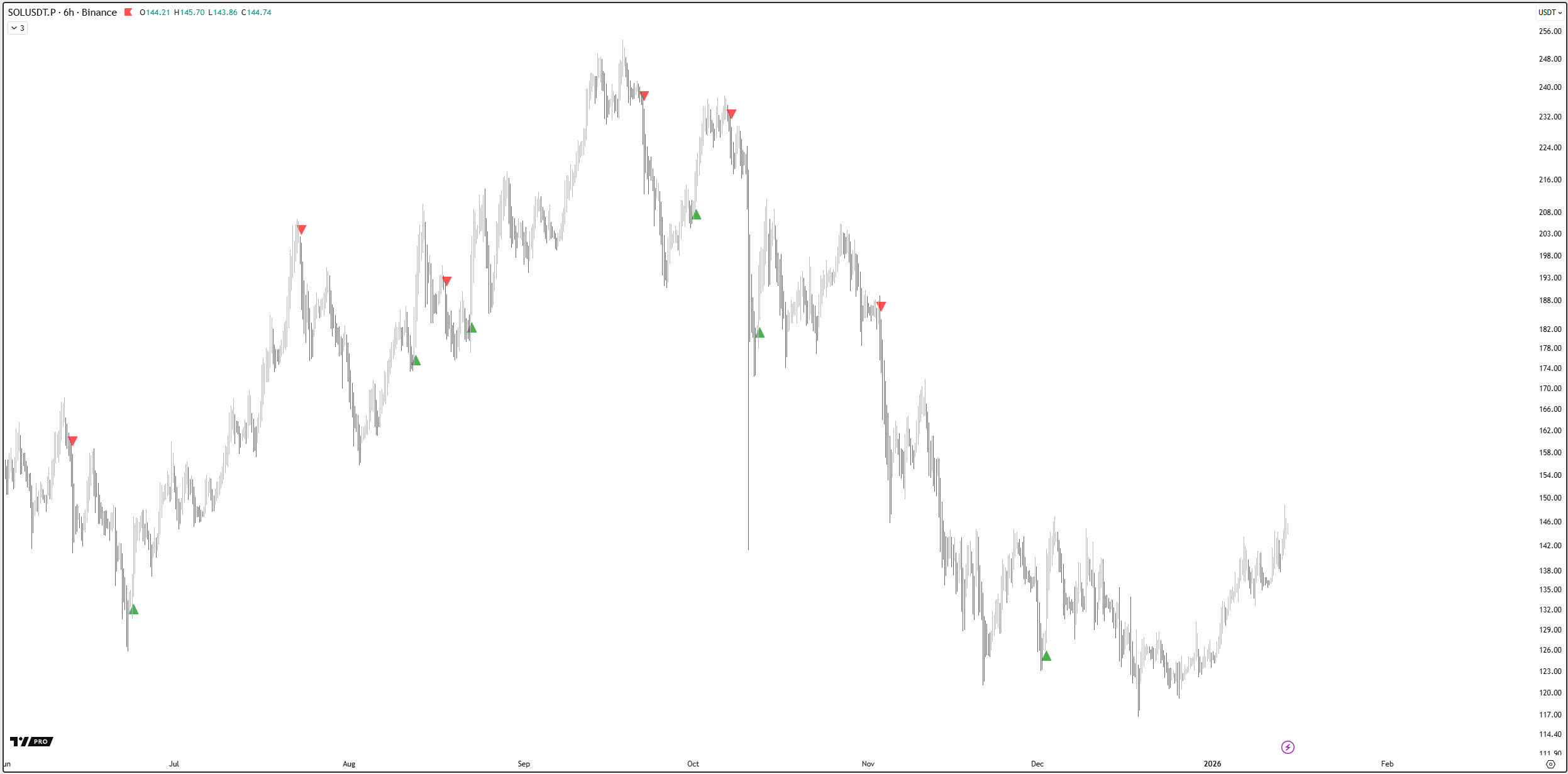

MAJORS (BTC ETH & SOL) the anchor assets. notice the system ignored the chop in november/december. it waited for the regime change before going long.

XMR - strong breakout. system caught the early expansion.

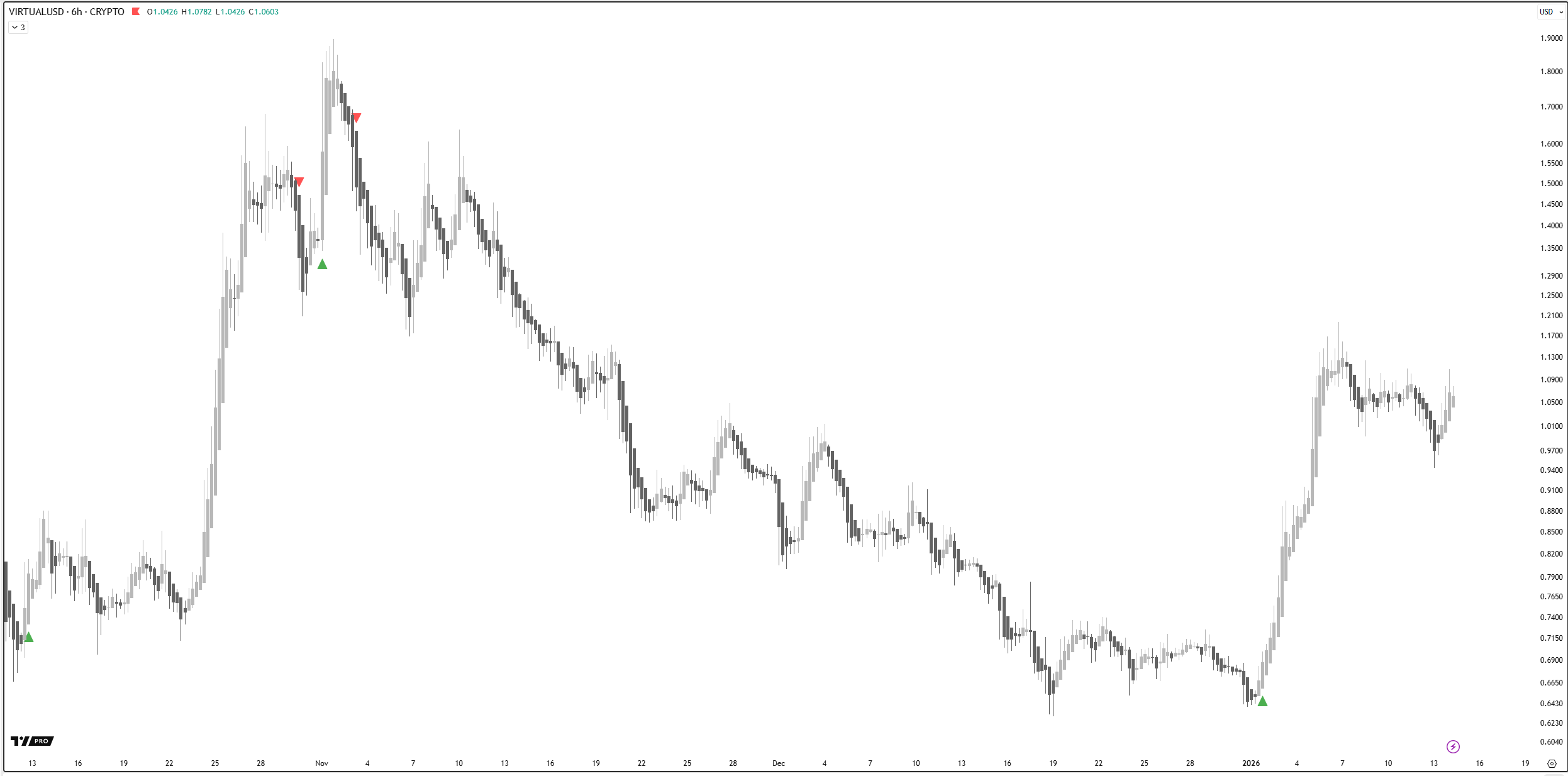

ALTS & MEMES (VIRTUAL, PENGU, FART, ENA) beta is waking up. this is where the noise is highest, and where the system provides the most value: filtering "scam wicks" from genuine trend reversals.

- virtuals/ai: high volatility, but the system identified the floor.

- memes: captured the reversals on high-beta assets like pengu and fart without getting chopped up in the prior downtrend.

- ena: catching a falling knife is dangerous; the system waits for the knife to hit the floor first. clean entry.

most energy should now be spent identifying the runners. let the system handle the entry/exit precision. don't fight the momentum.

see you in the next one.