Weekly Tradfi Update

As mentioned in the previous updates below

Trends on majors are looking exhausted. Need either a price or time correction to gain momentum.

While the long term is still bullish, there are signs of correction appearing in the short term.

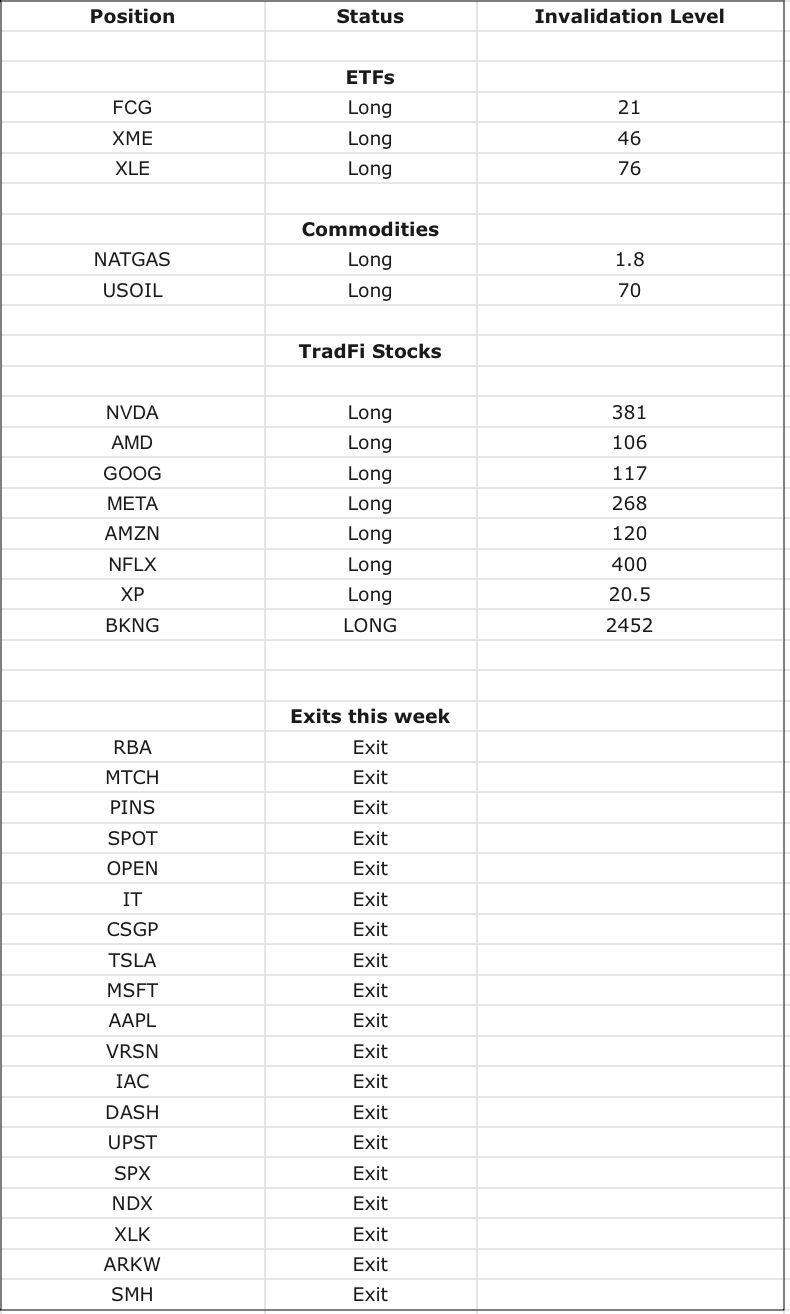

Model has made a lot of exits this week.

It important to remember, these are high time frame trades. Model has been long many of the names since Jan 2023. Many of them are up a lot.

Model will re-enter the positions again on resumption of the uptrend.

Model continues to be long commodities. The call has played out well thus far.

Among the macro variables, interest rates and bonds seem to be the most vulnerable spot. TLT continues to be weak.

One thing which is still a bit concerning for the bulls, is the bonds and interest rates. Still there are no visible signs of the rates cooling. TLT continues to look weak.

W3Q has published a How-To guide for those interested in learning how to best use the model insights. Check it out.

Coming to the model positions. There have been multiple exits and no new entries.

** Web3Quant is not registered with any financial regulatory agencies. Web3Quant is purely a research publishing firm that provides no personalized financial advice. Do your own research and consult your financial advisor.**