Momentum Still strong.

Web3Quant crossed 10K followers.

Despite starting in the bear market, W3Q posts consistently have a good views-to-followers ratio which shows we have an engaging community.

Thank you all for being a part of this journey.

Due to high number of DMs its hard to answer individual queries so

Let's do some of the questions first then get to the updates.

- "Should I Buy/Sell now? Which exchange should I buy/sell on?"

Something that has been repeatedly said before. W3Q is a research/educational subscription for DIY traders. Y stands for yourself.

All model positions and insights are made available. how you choose to use them is up to you.

W3Q won't be giving any personal financial advice nor will have a view on logistical matters such as what exchanges are good or bad to trade on.

I have also published a how-to guide to help with this. Since then there have been a lot of improvements to the model. Will soon be publishing a refresher on this guide.

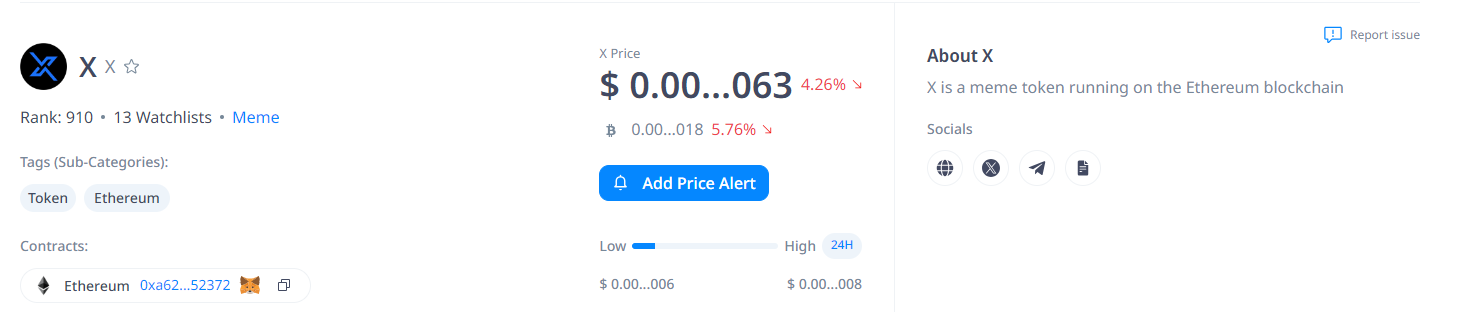

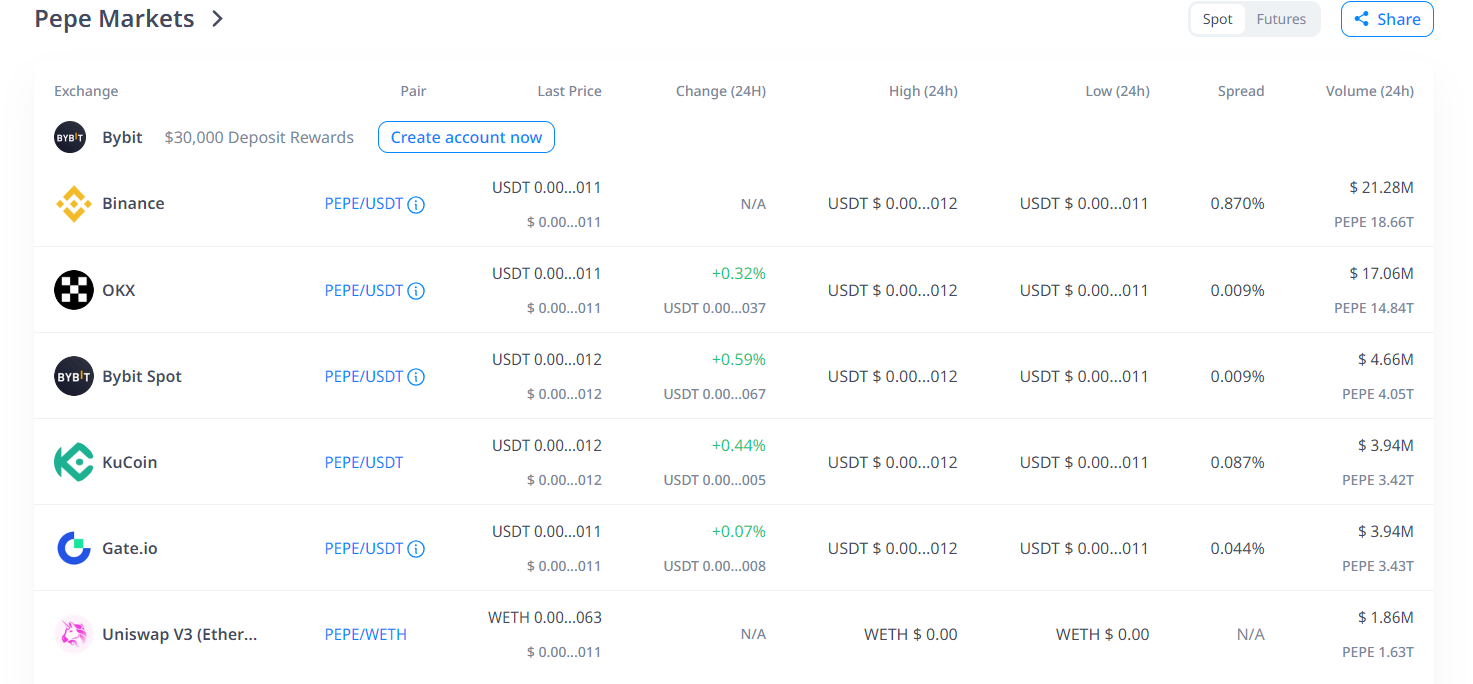

- "I cannot find this coin?"

cryptorank.io is a handy site. It has a ton of info on all coins including the contract address of the coins on-chain as well as what CEX they are listed on.

Some examples below.

- "Can you publish the model entry levels?"

As mentioned in the FAQs too, consider the Daily closing price as the entry/exit price.

One of the many reasons why it's not published it can cause a serious bias if one sees a lower entry price. causing them not to evaluate the insight and completely miss the entire move.

Also, model entry price or anyone else's should not be of concern.

What one needs to evaluate is after the longs are published. Do they do they work or not.

- Most of the coins names are on-chain names. Can you add more CEX names?

This is NOT true.

Majority of the the names in models longs are listed on CEX such as Binance, Mexc or Kucoin.

Use cryptorank.io and you will see it.

I just checked and found that apart from OXO all the other names in the model longs were found in the MEXC exchange.

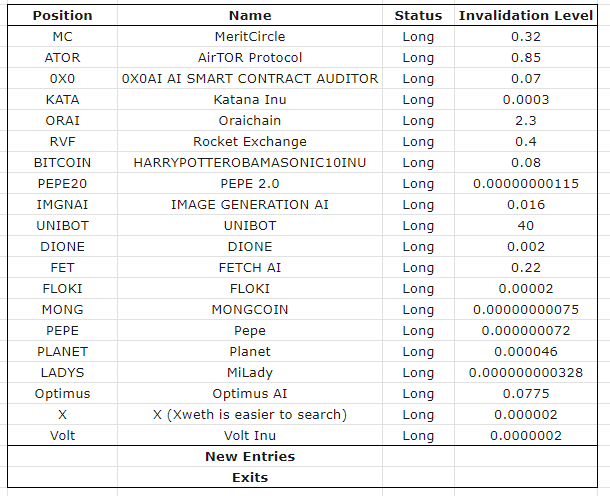

BTC ETH SOL MC ATOR KATA ORAI RVF BITCOIN PEPE20 IMGNAI UNIBOT DIONE FET FLOKI MONG PEPE PLANET LADYS Optimus X Volt

and ORAI is listed on Kucoin.

Not suggesting any exchanges are good or bad. just that the coins are available.

When it comes to on-chain all model longs are listed on UNISWAP.

- Can you make changes in the kind of names in the longs as I'm not comfortable with some of the low-quality names?

Won't get into the debate of what is quality and what is not. but

the very reason you follow Web3Quant is that it's data-driven and non-biased.

If that were to be changed trying to cater to everyone then it would defeat the whole purpose.

Model is designed to go after the strongest coins.

To filter out the bad apples numerous steps are taken (which I won't get into). Also, there's a durable volume filter to weed out volume fakeouts along with price fakeouts.

Ultimately crypto is where you have the opportunity to make 50x-100x and those come from smallcaps and not largecaps.

For those not comfortable with smaller names or who cannot participate due to liquidity constraints, there are a few 100m+ mcap longs in the model

apart from the Majors BTC ETH SOL etc.

Just to conclude, everything largely depends on what stage of the market we are in.

There were times when we played full defense by just sitting on CASH, sometimes it was moderately bullish with just BTC ETH longs.

While now most of Crypto Twitter is all over meme plays. The model went long a couple of weeks back Meme szn already? and most of the memes the model went long on have gained massively and we haven't hit peak craziness yet.

While who are into meme plays will rely on subjective insights. We will exit them when the HTF trend is exhausted.

Nothing is sacred. Nothing is good or bad quality. All that matters is price and volume. The rest is just an opinion. And the market's opinion is all that matters.

- "Invalidation levels are low."

The initial model was a weekly one with only once-a-week updates. Invalidation levels were given just in case there was a major event mid-week and folks needed some sort of exit levels.

Since then there have been lots of improvements to the model as mentioned here

Now we have real-time updates as needed. sometimes multiple times a week. So if there's an invalidation or an exit you would get an update.

Those static invalidations do not serve the same purpose as before. They can be used for sizing or trailing SLs etc.

Model will very likely exit well before those invalidations are hit.

Coming to Model Updates.

We have had another strong weekly close. Model continues to be long majors with the following invalidation levels.

BTC - 27k

ETH - 1600

SOL - 23

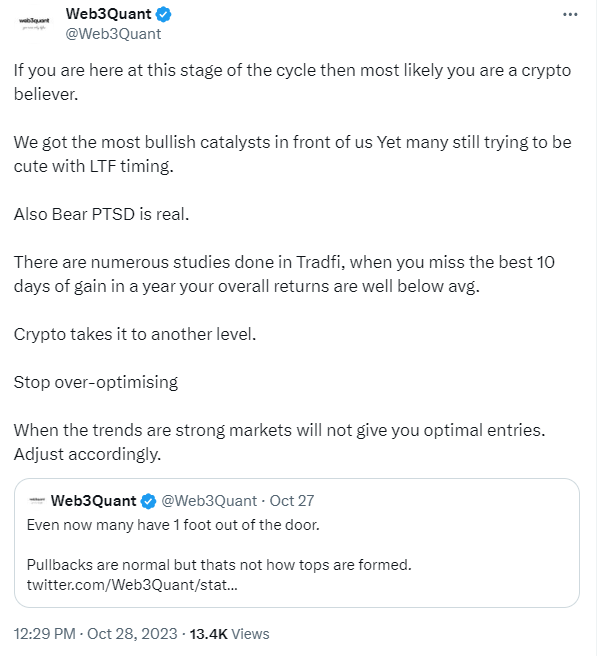

While the momentum has been strong theres very little interest level or signs of excessive optimism from the participants.

Most folks are still recovering from bear PTSD and there's still disbelief in the rally. This is usually a good sign.

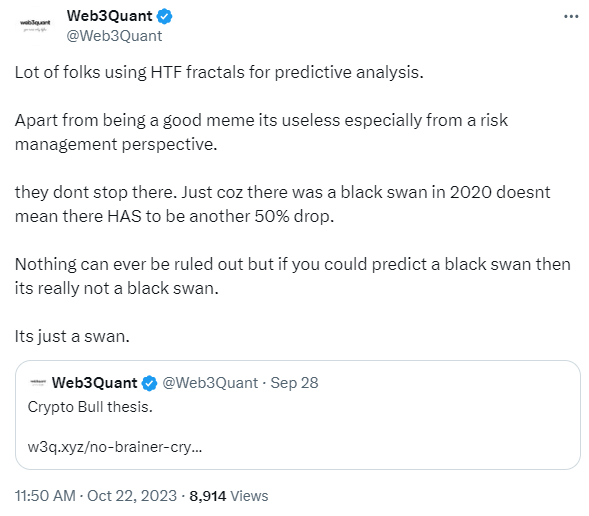

For better or worse there are a lot of folks almost certain of a black swan kinda correction.

Coming to model positions there are no new entries/exits

** Web3Quant is not registered with any financial regulatory agencies. Web3Quant content is purely for research, education, and entertainment purposes and should NOT be considered personalized financial advice. Do your own research and consult your financial advisor.**