Newsletter #31 Weekly Update

Model exited all crypto positions a couple of weeks ago and continues to sit on 100% Cash.

Models bearish call on US Dollar is playing out well. It went bearish about a month ago and since then $DXY is down about 6%.

Last week I wrote the following

Considering the magnitude of the move that's happened already, there could be some relief bounce to 109 levels from the current level of 106 but the price structure seem to have broken for now.

DXY did get some relief bounce close to 108 earlier in the week but then continued to head lower again.

Model continues to be bearish on DXY.

Regarding interest rates I wrote the following last week

The interest rates seem to have plateaued too.

The model is also bearish on US10Y.

The invalidation would be persistent closing above 4.5%

Models call on interest rates is playing out well. US10Y has moved from 3.9% to 3.6% since.

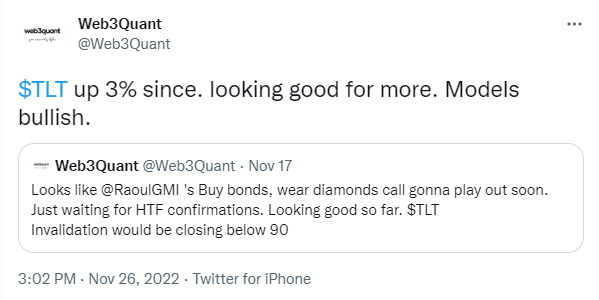

For those interested in bond markets, the model is bullish on $TLT.

Regarding stocks as mentioned last week too. The model continues to be bullish. S&P500, Dow Jones, and Nasdaq100 were up about 4% for the week.

Last week I wrote I also wrote

If one is interested in longs in stocks then Dow Jones is the strongest among the 3 US stock indices.

Here's an interesting chart of Dow Jones (DJI) vs Nasdaq100 . It took support at the exact same spot as it did in the year 2000 and started moving up. DJI showing strong relative strength on all time frames.

Model continues to be bullish on Stocks.

Coming to crypto, From a long-term investing perspective I am sticking to the plan I have been writing about for weeks.

Bitcoin and Ethereum are entering the value zone, if we do get a market-wide sell off then it would be a great time and price to accumulate these assets for those who believe in this space. The above logic applies to ALL cryptos/stocks that you believe will survive the next 5 years.

So I will buy either on a complete NUKE aka BTC in the range of 14k-17k if we get one or on a Long signal by the model. I would be using this opportunity to DCA into long-term holdings. $BTC & $ETH feature in them but I have also laid out a long-term investment thesis on crypto stocks. You can check them out here - HUT8 and Galaxy Digital. I also like Riot Blockchain (similar thesis to HUT8) and Coinbase.

From a trading perspective, until we get the breakout and the model gets into AltUSD positions there are some trading opportunities in the AltBTC pairs as suggested last week.

First, let's review last week's calls, and then we can get to the new ones.

Model bullish call on $LTCBTC has done really well. It's up over 40% since.

A lot of heavyweight crypto influencers have now given a buy call on LTCBTC much later on. Many of them are calling for all-time highs and insanely high targets. while anything can happen but I would be wary of such optimism and prefer to play it week on week.

Model continues to be bullish $LTCBTC

Models bullish call on XMRBTC call is playing out well. It was up 6% for the week.

Model continues to be bullish $XMRBTC

I gave another call on Twitter during the week.

Model call played out well here too and ASTRBTC was up over 40% in last than 5 days.

Model continues to be bullish $ASTRBTC

Model is bullish on $DOGEBTC.

Here one needs to be nimble and manage the trade tactfully via position sizing.

Model was bearish on $ETHBTC. After the move lower it closed back up to be flat overall. Model is currently neutral on it as there's no momentum on either side.

Below are the Models signals on BTC, ETH, and Solana from 2020 to date. I have been publishing this every week since I went public in May and will continue to do so.

** Web3Quant is not registered with any financial regulatory agencies. Web3Quant is purely a research publishing firm and does not provide any personalized financial advice. Do your own research and consult your financial advisor.**