Crypto Update

One of the new entries given earlier this week WIF has been on absolute fire.

Up about 5x

But the best part is that the volumes and social activities are up considerably which also opens up WIF to be listed on centralized exchanges.

There is a very high chance that BONK is the Doge of this cycle and WIF could be the SHIB.

Trend and momentum are waning on some of the other GAMEfi, memes, and OTHER sol ecosystem picks hence the exits.

NOTE: I have clarified in the past too but get questions every time there's an exit so addressing it here again.

There's a difference between thesis-driven core long-term positioning and HTF trades.

For instance, WOO was mentioned as a no-brainer cycle play in the bull thesis. But in the model trades it has entered, exited, and now re-entered. The same was done with memecoin $BITCOIN. Today you would notice WEN and FLUXB.

Model trades are based on HTF Trend, Momentum, Relative Strength, and Price action. Web3Quant indicator partially does some of that too.

Thesis is based on value. I have also detailed what factors I look for when shortlisting such plays here

There's been a lot of requests for updates to the bull thesis. Will be releasing that next month.

Theres no change in the market views to what was mentioned in the last update

Model is still long Majors BTC ETH SOL.

We could witness some chop and volatility due to the following reasons.

-Holiday season hence low volumes.

-Year-end tax-related selling/tax loss harvesting etc.

-Frontrunning the derisking of major BTC ETF approval decision in the first week of Jan.

These would matter a lot more to LTF traders than HTF.

The model would signal exit when there's durable evidence of waning momentum or if the trend breaks. So far there's none.

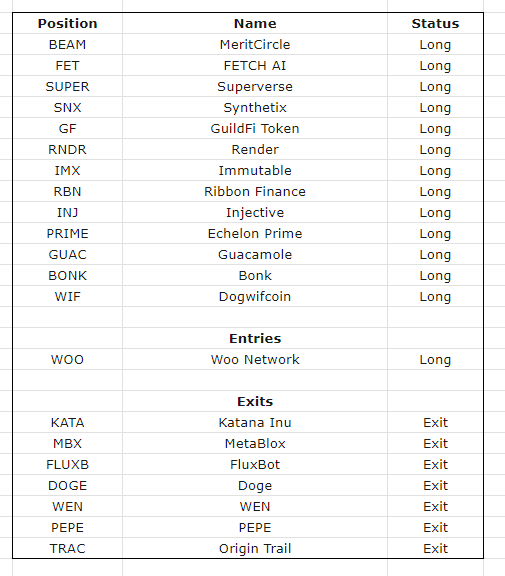

Heres the updated model positions.

** Web3Quant is not registered with any financial regulatory agencies. Web3Quant content is purely for research, education, and entertainment purposes and should NOT be considered personalized financial advice. Do your own research and consult your financial advisor.**